According to data released on the 14th of November the euro area did not do so well in the third quarter. Only a rose by 0.2% was noted compared to the second quarter, which is equivalent to just 0.6% on an annualized basis.

However, the Economist reports that Greece made a nice surprise since from the 14 countries in the 18-strong currency union Greece fared best and noted a growth by 0.7%.

The report continues by supporting that Greek recovery started in the first quarter of this year when it grew even faster by 0.8%, according to the new figures, while in the second quarter slowed to 0.3%.

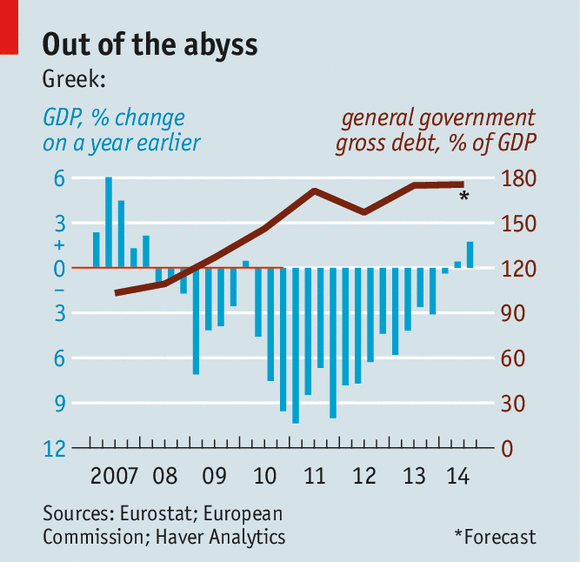

The upturn has meant that the economy is now growing on a yearly basis (see chart).

Apart from just before the first of two bail-outs in early 2010, this is Greece’s first spell of annual growth since the beginning of 2008. Between the pre-crisis peak, in the second quarter of 2007, and the trough at the end of last year, GDP contracted a decline by 27%.

A reported in the magazine, according to the commission’s forecast in early November, the recovery should strengthen next year, when it expects the economy to grow by 2.9%. Growth would come from higher household consumption and investment, as austerity eases, together with a boost from net exports.

However, that upbeat outlook may be undermined by political uncertainty.

The coalition government led by Antonis Samaras, which steered the country away from the abyss after two fraught elections in 2012, could fall next year, possibly as early as February.

Further, the Economist refers to the opinion of the polls that suggest that the next one may be led by the left wing party of SYRIZA whose policies would put it on a collision course with the euro zone’s creditor countries, especially Germany.

Already, ten-year government-bond yields, which had fallen below 6% during the summer, have risen above 8% as investors worry about the country’s political prospects.

Finally, the report concludes by stating that the foundations of this year’s growth in Greece were laid when the threat of a Grexit was removed. Should the jitters return, the Grecovery will surely wobble too.

Ask me anything

Explore related questions