The editors of Bloomberg are urging Greece’s creditors to change their stand on Greece in an article they have jointly written, titled “Give Greece a Chance.” The editors advises Greece’s international creditors from the European Commission (EC), European Central Bank (ECB) and the International Monetary Fund (IMF) to “stop insisting on the impossible, and find a way to relieve the country’s debts.”

The article refers to the international creditors’ action as “toxic” and states that further efforts to reduce debt through fiscal tightening are almost certain to fail and could “plunge the country into political instability.”

The article refers to Greece’s achievements, that include turning its primary budget (excluding interest payments) from a deficit of 10.6% GDP to a surplus of 1.5% – a difference of more than 20 bln euros a year. The article worries that the “fiscal squeeze has hurt the economy” by reducing Greece’s output by a fifth and increasing the unemployment rate to 25%.

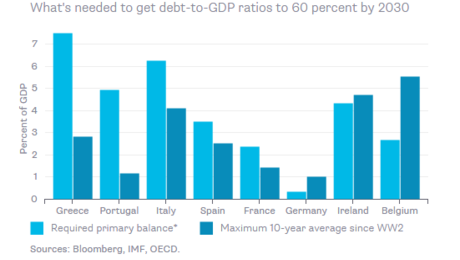

The editors of Bloomberg believe that fiscal austerity isn’t the solution. “Even if growth proceeds apace and borrowing costs stay managemable, the government would have to reach and maintain a primary surplus of 7.5% of GDP over the next 15 years. No euro area country has ever come close to doing that,” says the article.

The article also warns that too much austerity could put the main opposition Coalition of the Left SYRIZA party in charge, ending fiscal discipline. Then, the entire European project will be endangered. “Rising opposition parties in Portugal and Spain are similarly inclined, and they are watchign closely,” warn the editors, stating that in this case, the whole of Europe could be thrust back into the crisis.

Creditors such as Germany and France would do well to show “debt forgiveness” so that there is no “disorderly default.” “The sooner they recognize the need for relief, the better their chances of heading off a far worse calamity,” says Bloomberg.

Ask me anything

Explore related questions