Bolstered by its third bailout programme and positive reports from the European Union, Greece is planning an imminent test of the bond market, local media said this weekend.

Greece is eyeing “the current positive trend” in the market, where liquidity levels are high and there is a taste for risk-taking, the conservative Kathimerini newspaper said.

Avgi, the newspaper of the ruling Syriza party, said that Athens would “probably” test the waters as early as Monday, “even though nothing can be taken for granted.”

Whether Athens will take the plunge as soon as that is unclear but the Greek government seems eager.

“It is our priority to make some test re-entry to the markets so we can prepare the ground for August 2018,” government spokesman Dimitris Tzanakopoulos said on Sunday, referring to Greece’s emergence from the long-running bailout programme.

“Nevertheless, the timing of this is something we are thinking over,” he said in an interview with Documento newspaper.

“We want to have our first return to the bond markets at the best possible timing. I can assure you this won’t happen with the goal to impress. This will be a part of our global strategy for regaining definitive access to the markets.”

Greece has no immediate need to tap the bond markets for cash.

The European Stability Mechanism (ESM) will keep feeding the debt-ridden country with low-rate loans until the end of the bailout programme in July 2018.

That support gives Athens a low-risk opportunity to test its standing in the capital markets after a tumultuous period of “Grexit” scares and painful reforms.

The Greek economy nearly collapsed in 2010 under a mountain of debt.

It had to be repeatedly bailed out by its eurozone partners to prevent it bringing down the single currency bloc. Its third bailout, worth 86 billion euros ($97 billion), was agreed in 2015 and came with a tight list of conditions.

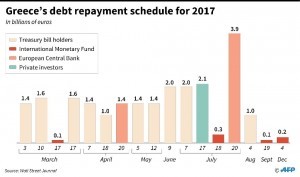

Last week eurozone finance ministers approved the latest 8.5-billion-euro ($9.75-billion) tranche, in time for Athens to meet major repayments on its 314-billion-euro overall debt bill and avert a default.

(Click to enlarge)

According to European Commission figures the tide is now turning at last for Greece.

The country ran a budget deficit of 15.1 percent in 2009.

This turned into a surplus of 0.7 percent last year, which is expected to post further progress this year as more savings are found.

The European Union, in a further boost for Athens, recommended Wednesday that Greece has made enough progress in balancing its budget to be removed from the EU “deficit blacklist”, the special oversight of government spending.

Last month, the Eurogroup did its bit to help pave Greece’s return to the markets.

“Future disbursements should cater not only for the need to clear arrears but also to further build up cash buffers to support investors’ confidence and facilitate market access,” it said.

‘Rather early’

Last Monday, Klaus Regling, the ESM’s managing director, said it was “a good moment” for Greece to consider how to return to capital markets.

He pointed out that Ireland, Portugal and Cyprus had also done so before the end of their bailout programmes.

“Greece’s return to the markets is the step that everyone is waiting for,” the European Commissioner for economic and monetary affairs, Pierre Moscovici, said on Wednesday.

But other voices are cautioning Athens not to jump into the capital waters too soon.

Bank of Greece governor Yannis Stournaras said on Tuesday that it was “rather early” for a return to the bond markets.

In an interview with the Wall Street Journal he said: “It would be even better, for instance, if Greece proceeds with two or three emblematic privatisations in the period to come. That would be more helpful to tap markets later.”

Market sentiment may also become volatile from September given possible changes in ECB monetary policy or in Germany’s election results, other commentators say.

Last time Greece issued bonds was in 2014 under the coalition government of Antonis Samaras with a yield of 4.95 percent.

The goal of current Prime Minister Alexis Tsipras is a lesser yield, according to Kathimerini.

Ask me anything

Explore related questions