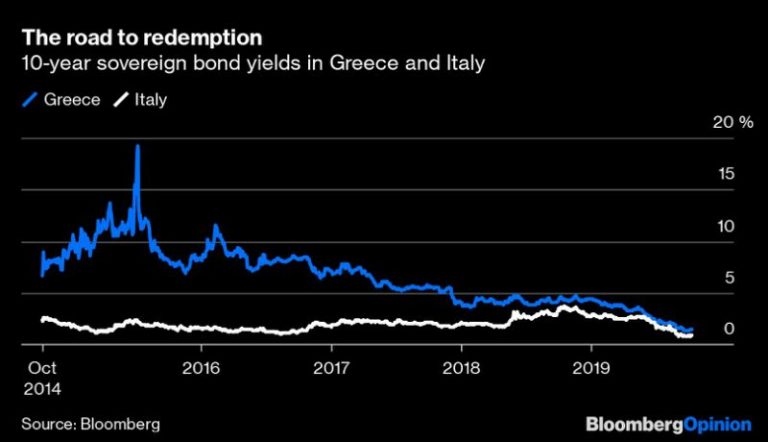

If you want a snapshot of how far the euro zone has come, look no further than Greece and Italy.

Until recently, the two Mediterranean countries have been considered the sick men of Europe, as investors demanded hefty premiums to hold their sovereign bonds. These extra charges were all the more striking given the steep fall in the yields of other countries that had been engulfed in the sovereign debt crisis of the early 2010s, namely Spain, Portugal and Ireland.

Greece and Italy have finally joined the party too, but there are still reasons to be skeptical. The two countries continue to suffer from very high levels of public debt, which weak economic growth has failed to erode. And while the financial markets seem to like the new governments in Athens and Rome, there is a risk that these administrations prove too optimistic in their forecasts for how fast their economies will expand and how quickly their budget deficits will shrink.

Last week saw symbolic moments for both countries. Greece issued new three-month debt at a negative yield for the first time, joining a growing list of countries in Europe and beyond which enjoy the privilege of being paid to borrow money. Meanwhile, Italy sold dollar-denominated bonds for the first time since the start of this decade. The auction was a resounding success, as Rome placed $7 billion of debt on the market, more than double an initial estimate, after receiving orders of more than $18 billion.

In both cases, the successful bond sales crown months of extraordinary comeback. A 10-year Greek bond yielded more than 3.5% in mid-May, with a spread of over 360 basis points compared to Germany. It now yields less than 1.5%, as the spread has fallen below 200 basis points. Over the same time period, Italy’s 10-year bond has fallen from around 2.7% to below 1% today. The spread with bunds of similar duration has halved from around 280 basis points, to roughly 140 basis points.

Read more HERE

Ask me anything

Explore related questions