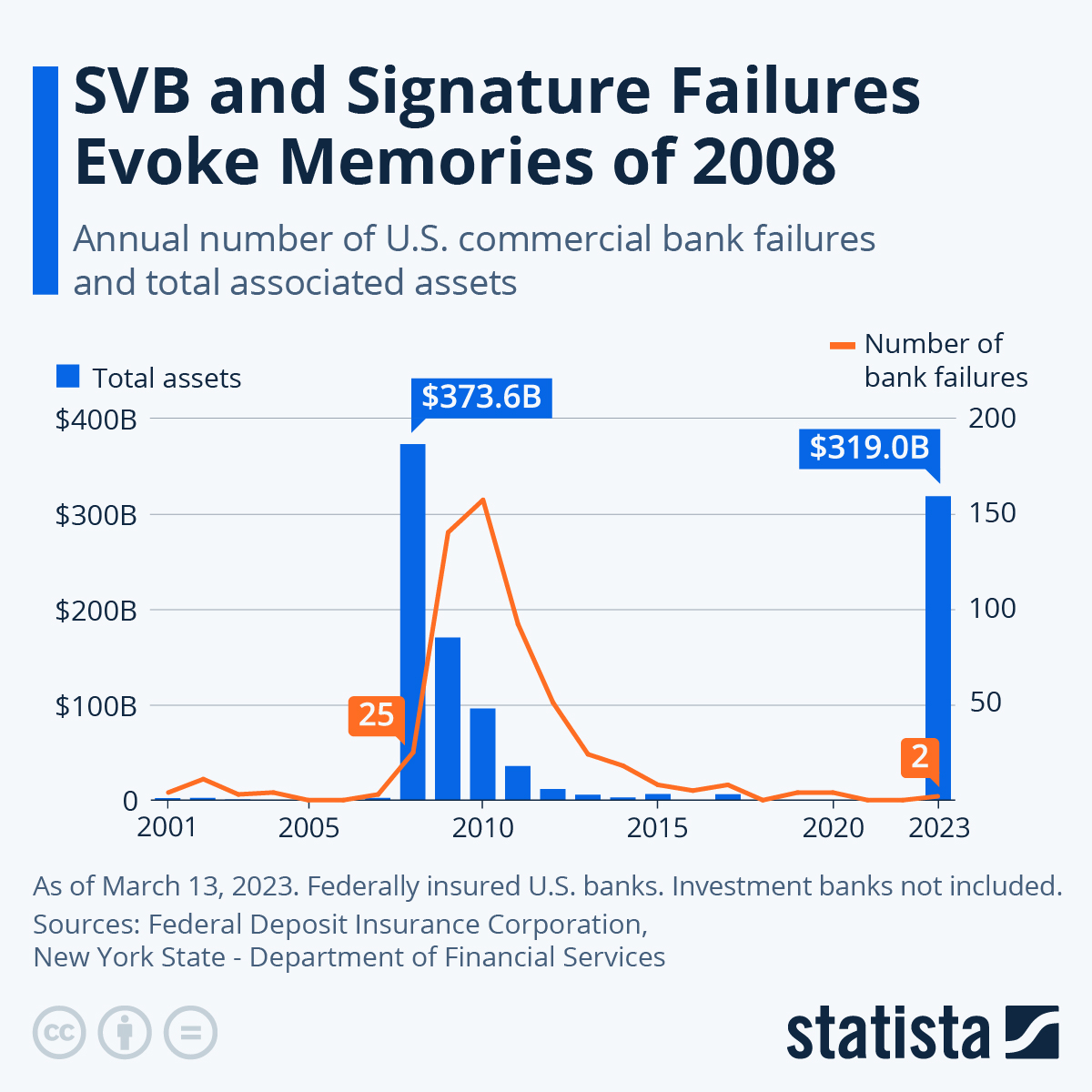

The scale of the bank failures that have hit the U.S. financial system are, when looking at the total associated assets, on an alarmingly similar scale to those recorded in 2008 – albeit being caused by just two banks: Silicon Valley Bank and Signature Bank. This compares to 2008’s 25 failed commercial banks, as our infographic using data from the Federal Deposit Insurance Corporation (FDIC) and the New York State Department of Financial Services illustrates.

Despite the similarities in terms of asset value, opinions remain mixed on the chances of these failures sparking a crisis similar to 2008. Bank of America analyst Ebrahim Poonawala is quoted by Reuters as saying the current situation is due to “idiosyncratic issues at individual banks”. Erika Najarian, bank analyst at UBS Securities had a similar reaction to the SVB news, commenting: “The sector’s knee-jerk reaction is understandable, but likely overdone.”

Showing more caution, R. Scott Siefers, Managing Director at Piper Sandler, said on Friday: “This week’s events increased our fears that it will be tough for this space to find sustained higher ground until some of the myriad uncertainties crystallize. And while this week’s stock price action may have seemed shocking, the reality is that some of the related issues could certainly take a while to resolve.”

You will find more infographics at Statista

Ask me anything

Explore related questions