The “freezing” for another year of the interest rates charged on the fixed arrangements of overdue debts of individuals and legal entities to the tax administration, provides for an amendment of the Ministry of National Economy and Finance, which was included in the bill of the Ministry of Digital Governance.

The regulation is intended to contain the cost of servicing regulated debts during a period of generalised interest rate increases in the eurozone, preventing an additional burden on taxpayers. Specifically, the interest rate for installments on established debts that have been subject to a regulation remains stable until 31 March 2026, at the level that was set until 31 March 2024.

– The interest rates that remain unchanged are:

– 4.34% for arrangements up to 12 installments

– 5.84% for more than 12 installments

– For a second subjection to regulation (after loss of the first), the interest rates are as follows:

– 5,84% for up to 12 installments

– 7,34% for more than 12 installments

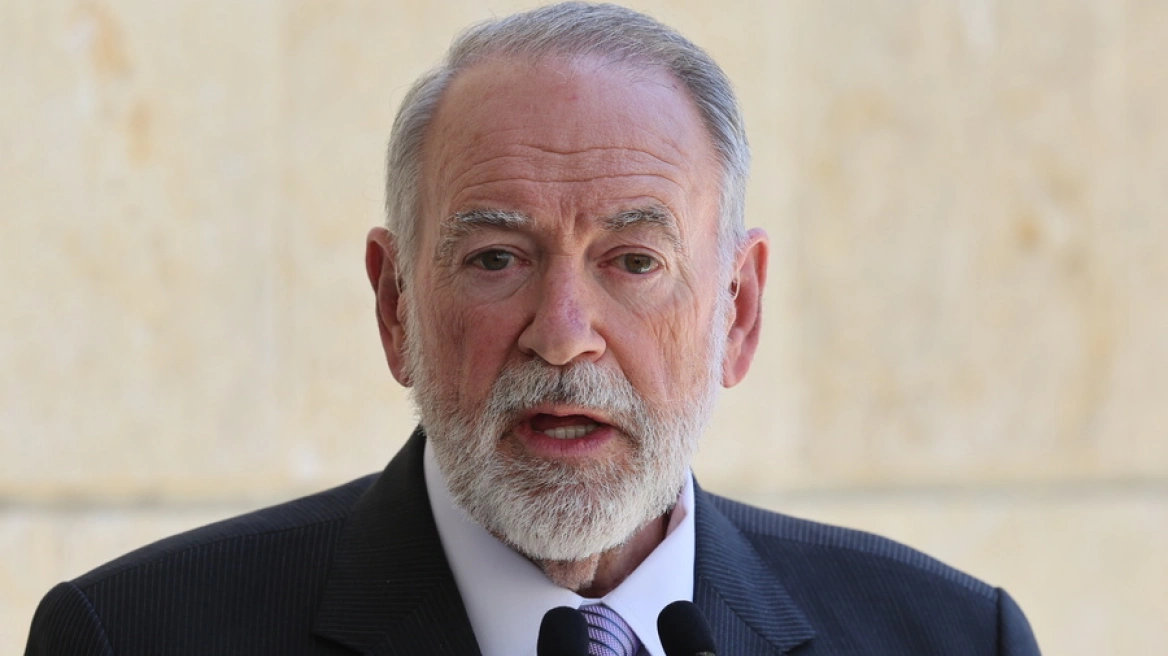

The second provision of the amendment extends the operation of the External Tax Dispute Resolution Committee, in order to complete the examination of applications already submitted by taxpayers. As noted by the Deputy Minister of National Economy and Finance, Giorgos Kotsiras, during the relevant debate in the Plenary Session of the Parliament, the procedure of out-of-court resolution of tax disputes was institutionalized in 2020, contributing to the rapid resolution of disputes and the decongestion of administrative justice.

The third regulation extends for the year 2025 the exemption from paying Taxes for properties located:

– in areas affected by earthquakes, such as Larissa, Trikala, Karditsa, Pieria, Grevena, Kozani and Fthiotida,

– in areas affected by fires, such as the municipalities of Mantoudiou – Lini – Agia Anna and Istiaiaia – Edipsos in North Evia,

– in areas affected by fires, such as the municipalities of Mantoudiou – Limni – Agia Anna and Istiaiaia – Edipsos in North Evia,

– in areas under compulsory expropriation (e.g. the settlement of Anargyron in the Municipality of Amyndeon),

– and in urban inactive settlements, such as Peponia, Polylakkos, S Αξιοkastro, Trapezitsa, Panareti and Pylori in the P.E. Kozani, as well as Kalamitsi, Kaloinokoi and Mesolakkos in the P.E. Grevena.

At the same time, the deadline for applying for exemption is extended for another year, in order to ensure that beneficiaries do not miss the opportunity due to administrative delays or ambiguity.

Ask me anything

Explore related questions