The French newspaper Le Monde highlights this early repayment as a significant advantage for the French economy, helping reduce its deficit, especially at a time of serious fiscal challenges in Paris. This repayment, originally due after 2033, is now scheduled for 2025.

The move reflects Greece’s regained credibility in international markets, with Le Monde noting that Greece is now considered a safer borrower than France, with slightly lower borrowing costs.

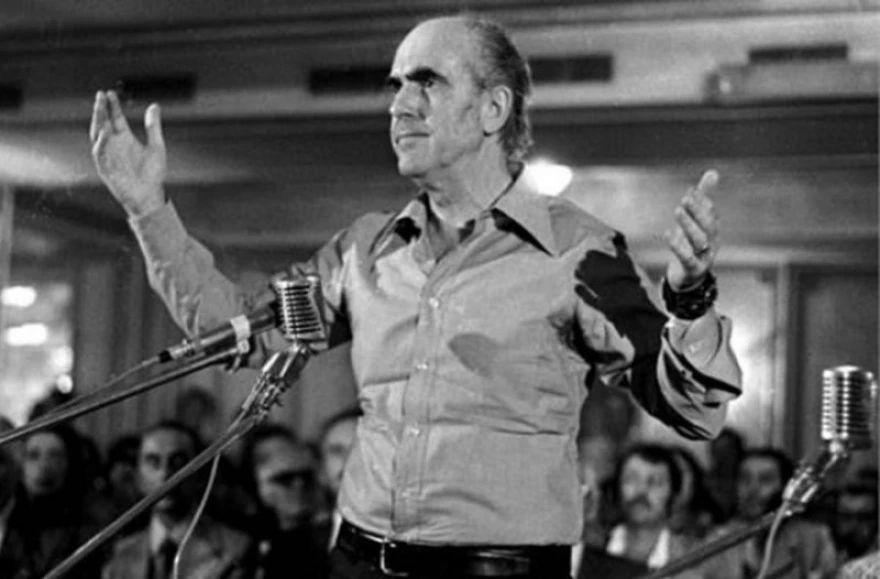

This change marks a clear shift: from being seen as a risky, bankrupt member of the Eurozone, Greece is now a reliable and creditworthy partner, able even to assist those who once criticized it, like France during Nicolas Sarkozy’s presidency.

This turnaround did not happen overnight. It is the result of painful sacrifices by the Greek people and consistent policies aimed at restoring trust in the Greek economy. Credibility is not given freely on the international stage—it must be earned through clear priorities, programs, and tangible actions, such as early debt repayments.

Despite ongoing challenges such as inflation and energy costs, this regained economic credibility has allowed Greece to support its citizens through relief measures that would otherwise be impossible.

A Look Back at Greece’s Debt History

The country’s debt problems have deep roots. In 1993, Greece’s public debt first exceeded 100% of GDP. Despite some growth spurts, the debt continued to rise sharply in the 2000s. The financial crisis of 2009 pushed debt to nearly €300 billion, or about 130% of GDP.

In 2010, Greece entered bailout programs with the IMF and Eurozone partners, beginning a long period of austerity, economic hardship, and social strain. Debt kept rising, reaching over 170% of GDP in 2011 and peaking near 206% during the COVID-19 pandemic in 2020.

The bailout loans came in several stages, with total loans from Eurozone countries and the IMF reaching over €250 billion at their peak.

Repayment and Recovery

Since 2019, Greece has accelerated repayments, paying off IMF loans earlier than planned. This has reduced the cost of borrowing and improved market confidence.

Early repayments of European bailout loans have also begun, with scheduled payments in 2022, 2023, and 2024, and more planned for the coming years.

Despite pandemic-related setbacks, Greece’s debt-to-GDP ratio has steadily improved, and it is projected to fall below 140% by 2026—the lowest level since 2010.

This progression reflects a new chapter for Greece—moving from crisis to recovery, rebuilding its standing in Europe and the global economy.

Ask me anything

Explore related questions