Widespread tax violations was uncovered by auditors of AADE who conducted an investigation at the “Nammos” of Mykonos.

For 2018-2019 alone, the amount of tax evasion at the Mykonos restaurant, which is run by Zannis Frantzeskos and Sami Ibrahim, is 1,562,529.81 euros and, including the fine and surcharges, totals 3,119,434.51 euros. The fine was notified to two of the three founders of the famous Myconian restaurant – the third one left permanently seven years ago – who manage the business.

The duo of Franzeskos and Ibrahim after the deal with ADMO, a company owned by Sheikh Takhoun bin Zayed al-Nayan of Abu Dhabi, own 55% and 45% of ADMO. According to ADO auditors, the two managers allegedly set up at least 58 IKE companies to which they transferred most of the company’s financial liabilities.

The audit will continue for the coming financial years, and, according to reports, apart from the tax evasion and income evasion revealed by the AADE audit, there are also many complaints from employees at “Nammos” in Mykonos.

The debts and the scheme

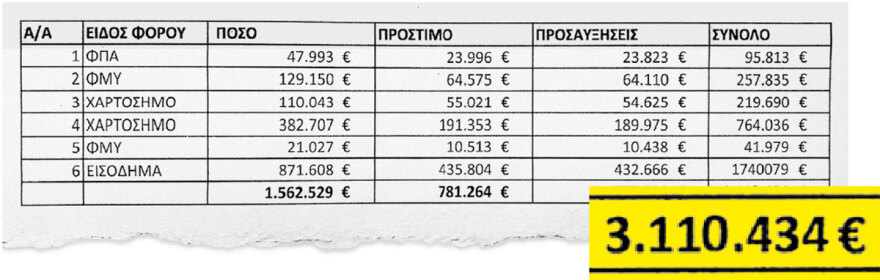

According to the audit conducted by a team of the AADE, only for the year 2018-2019 the business that from Nammos restaurant by the sea (NRBS) was suddenly renamed ZS Restaurants S.A. (from the initials of their names apparently) did not pay VAT, FMS (Payroll Tax) insurance and income tax.

More specifically, the amount of VAT amounts to 47,993.12 euros, i.e. it is just below that of 50,000 euros or more which brings prosecution for the specific offence of non-refunding of this tax. The two partner-managers also failed to remit to the state the FTT amounting to 129,150 euros and 21,027.78 euros as well as two paper stamps worth 110,043.20 and 382,707.29 euros respectively.

Finally, the income tax amounting to 871,608.42 euros was not paid, with total debts reaching 1,562,529.81, while the accountant of “Nammos” Chrysostomos Koukovinos probably did not have convincing answers during the audit. This was followed by the fines imposed by the AADE, which totaled 781,264.91 euros, but also the appropriate surcharges that reached 775,639.80 euros.

Despite the tax and contribution evasion identified by the auditors, the two partners continue to live a luxurious life outside the Greek borders with Zanni Francesco permanently residing in Monaco and Sami Ibrahim in Dubai.

Nammos restaurant by the sea (NRBS) through a labyrinthine route became Nammos World IKE and ended up ZS Restaurants, while the duo maintain these other 58 related companies that were or are linked through receivables and payables to each other. Some of them have names like Sami Investment, Nasser Royalties, Zenane Holdings, Naura Investments, Anezan Investment which are the names of their children, while others acquired fanciful names like Beautiful Sunset.

Continuity of controls and engagement

Following the initial findings, audits will continue for all previous years, and within the week Zanni Francesco and Sami Ibrahim will be notified of the final total fine of 3,119,434.51 euros. The formal procedure then provides for the freezing of the corporate accounts as well as those of two managers of Myconian “Nammos”.

Franzeskos and Ibrahim hold a 55% stake in the Mykonos restaurant, while ADMO’s Arabs have 45%, which does not allow them to have a say in its management and operation.

Although the two partners had pledged after signing the deal, which was followed by the repayment of all the debts they had incurred to the state and suppliers, that everything would now operate by the book in Mykonos, this did not happen. They have also not accepted, as had been explicitly agreed, that the Arabs would bring in a financial director of their choice, and have not allowed the audit by a certified public accountant for the 2023 financial year in which ADMO had also entered the company with a 45% stake.

Thus, the problems of mismanagement and debts to the state have returned, while several suppliers, including a well-known manufacturer on the island, are one step away from following the legal way, having not been paid for months.

No dividend

In fact, the Arab partners have not seen a single euro dividend from their investment in Mykonos, at the same time that the equivalent “Nammos” in Dubai was last year named the world’s most profitable restaurant with a turnover of more than 60,000,000 euros. There the percentages are 70% for ADMO and 30% for Francesco – Ibrahim, who have no say in management, which shows, if anything, how differently the two businesses operate.

According to reports, the August salary to the employees was paid at the end of September, while the tips from this season, amounting to 1,200,000 euros, have not been paid to them and have been withheld for the time being (!) by the two managers.

In contrast, their French and Italian colleagues at Nammos in the Côte d’Azur were paid on time because the French public sector is relentless when it comes to such practices by employers.

The ADMO fund’s response

In response to a question posed by THEMA to ADMO, which invested in the company in question in 2023, about the tax evasion uncovered by ADMO at “Nammos” in Mykonos, sent the following statement.

As investors, ADMO Lifestyle Holding (ADMO) had no prior knowledge of the fine or any tax or financial violations related to the individual companies and the ownership of “Nammos Mykonos”.

They go on to clarify that they cannot have knowledge of the actions of Francesco – Ibrahim at “Nammos” Mykonos noting: “Our role is limited solely to that of an investor, with no involvement in operations or day-to-day management, and such practices do not reflect our values and our commitment to transparency and compliance with corporate rules. In our dealings with some of these companies, ADMO relied on representations and signed letters of warranty, which explicitly disclosed that there were no outstanding debts to third parties or the government.

In addition, we maintain full financial and fiscal transparency on the assets we directly manage, namely “Nammos Dubai” and “Nammos Hotel”. We have full confidence in the Greek tax and financial authorities, and believe in their integrity and capabilities. In fact, we request a full and impartial investigation, as ADMO remains committed to transparency and compliance with corporate rules.”

Ask me anything

Explore related questions