For all the histrionics, from the 2018 tweet “considering taking Tesla private” for which he incurred a $20 million fine from the U.S. Securities and Exchange Commission to smoking weed during a podcast and his latest foray offering to buy Twitter Inc. for about $43 billion, Elon Musk is a pretty good business manager. In fact, the chief executive officer of the world’s most valuable automaker has no equal.

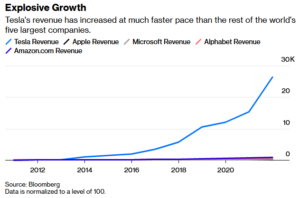

Among the 10 largest publicly-traded companies, Musk’s Tesla Inc. is No. 1 in growth the past decade with revenue increasing more than 260-fold to $53.8 billion; No. 1 the past 12 months with sales surging 71%; No. 1 in share performance over five and 10 years with its stock appreciating 15- and 146-fold, respectively, to a recent $1,000; and No. 1 in employment by more than quintupling its workforce since 2016, according to data compiled by Bloomberg.

A world ravaged by climate change brought on in part by the overuse of fossil fuels makes electric-vehicle maker Tesla increasingly the choice of fleet operators because of the minimal fuel and maintenance costs of its zero-emission cars. That’s a big reason why Austin, Texas-based Tesla’s sales growth will be No. 1 next year (30%) and again in 2024 (18%), according to the median estimate of 33 analysts surveyed by Bloomberg.

Among the six companies with at least a $1 trillion market capitalization, none achieved the milestone as quickly – and stayed there – as Tesla, which did it 11 years after its initial public offering. It took Apple Inc. 38 years, Microsoft Inc. 33 years, Google parent Alphabet Inc. 16 years, and Amazon.com Inc. 23 years. Facebook parent Meta Platforms Inc. reached $1 trillion nine years after its IPO but has since dropped back to $600 billion, according to data compiled by Bloomberg. 1 The stock market deems Tesla almost four times as valuable as the second-largest automaker, Toyota Motor Corp., and worth about 57% of the 10 biggest combined. Looked at another way, Tesla accounts for 41% of the total value of the 184 publicly traded vehicle manufacturers worldwide.

Read more: Bloomberg