Prime Minister Kyriakos Mitsotakis pledged to repay two years of bailout loans ahead of schedule in a confident signal to financial markets at the start of his second term in office.

“We will be able before the end of the year to actually repay ahead of time,” Mitsotakis said Tuesday during an interview with Bloomberg Television in Athens. “It’s a commitment to investors.”

Mitsotakis won a resounding majority last month for another four years in office, giving his conservative administration a mandate to implement investor-friendly policies he’d touted during his campaign. That will mean chipping away at Greece’s €356 billion ($388 billion) of debt, the highest relative to output in the euro area.

Mitsotakis said he aims to regain Greece’s investment-grade sovereign credit rating this year, 13 years after it was lost at the beginning of a long, painful financial crisis. The 55-year-old premier also vowed to accelerate his efforts to upgrade the Greek economy and to reduce the debt burden.

NEW: “It’s a commitment to investors”

Greek Prime Minister Kyriakos Mitsotakis pledges to repay two years of bailout loans ahead of schedule, in a confident signal to financial markets at the start of his second term in office https://t.co/VyNgXpsxKl pic.twitter.com/imbTeV3FHy

— Bloomberg TV (@BloombergTV) July 4, 2023

“I want to continue making Greece a very attractive destination for foreign investment,” he said. “Not only are we focused on growth, but we also want to make sure that our debt to GDP ratio continues to decline at a very rapid pace.”

Greece’s two-year bonds erased a decline after Mitsotakis’s comments, with the yield at 3.42% after trading as high as 3.56% earlier on the day. Benchmark 10-year notes were little changed.

The early repayment of the so-called Greek Loan Facility will mark a symbolic step for Mitsotakis as he seeks to consign to the past the years of financial turmoil which saw his country come close to losing its place in the European currency union and left it as the the only euro area member with a junk rating. Moody’s Investors Service and Scope Ratings both said that Mitsotakis’s electoral win was a credit positive event for the country.

Investors have piled into Greek bonds this year on the expectation the nation will regain an investment grade, making them the best performers in the developed world. That has cheapened the nation’s borrowing costs to such an extent that it now pays less than Italy, even as Rome’s debt is deemed safer by rating firms.

“We are already trading as if we are an investment grade country, but we also need the official stamp of approval by the rating agencies,” Mitsotakis said.

Greece’s 10-year bond yield fell almost 80 basis points this year to 3.7%, compared to a 10 basis points drop in equivalent German notes to about 2.5%. The yield spread between Greece and Italy’s benchmark bonds reached minus 50 basis points, the lowest on record.

UK: No 10 issues warning to banks after Nigel Farage uproar

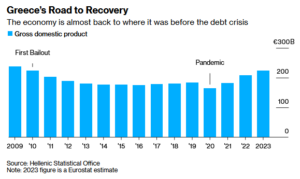

Mitsotakis made his stewardship of the economy a central pillar of his re-election campaign, with gross domestic product having recovered to just about where it was when the country lost its ability to repay its debt in 2010. Unemployment has more than halved from its peak of 28%, and stocks and bonds have soared. The Athens Stock Exchange General Index is up more than 39% this year.

Mitsotakis has also said he will seek to tackle Greece’s current account deficit, which, due to the energy-price shock, reached 9.6% of GDP in 2022 from 5.5% the previous year.

Greece has already repaid the full amount of loans provided by the International Monetary Fund ahead of schedule and has started to repay bilateral GLF loans provided by European countries early.

This facility was part of the first financial support program for Greece, agreed in May 2010 amounting to €53 billion. Up until now the country has repaid just over €8 billion, of which €2.6 billion was an early repayment.

In June’s general election, the second in just over a month, Mitsotakis’s center-right New Democracy party got 41% of the vote, giving it 158 members in the 300-seat parliament. Mitsotakis has been the only New Democracy leader to increase the party’s share of the vote after a first four-year term in office and he also secured the largest winning margin since 1974.

Source: Bloomberg