The offspring of prominent Greek business families are implicated in an insider trading case revealed in New York that resulted in the arrest of a Goldman Sachs banker.

George Nikas (son of the late Panagiotis Nikas, founder of the homonym delicatessen industry) and Telemachos Lavidas (who is the son of businessman Thanassis Lavidas of Lavipharm) were reportedly involved in inside trading deals, which resulted in the former acquiring 2.6 million in illicit profits, according to a U.S. Securities and Exchange Commission complaint.

The revelations led to the resignation of George Nika’s resignation from the position of Chairman of the Board of Directors of PG Nikas SA.

The Goldman Sachs Group Inc (GS.N) investment banker maned in the SEC complaint was Bryan Cohen and was released on bond, a bank spokeswoman said on Saturday.

Bryan Cohen, a vice president at Goldman Sachs who works in the Consumer Retail industry group, was arrested early Friday on charges of conspiracy to commit securities fraud. He was also sued by the U.S. Securities and Exchange Commission and accused of improperly using insider information about impending corporate deals.

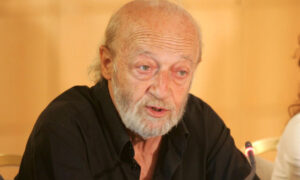

The SEC complaint named George Nikas, 54, who has homes in New York and Athens and owns a restaurant chain “GRK Fresh” that includes locations in Manhattan. A lawyer for Nikas could not immediately be identified on Saturday.

The complaint says the pair participated in a scheme that netted Nikas at least $2.6 million in illicit profits by trading shares in two companies. Cohen passed on non-public corporate deal information to an unnamed trader who in turn gave it to Nikas who used it to illegally trade securities, the SEC said.

Cohen got cash in exchange for information he gave the trader.

The trader and Nikas “realized millions of dollars in illicit gains from trading the securities of at least two different public companies — Syngenta AG and Buffalo Wild Wings Inc — in advance of news that these companies had been targeted for acquisition,” the SEC said.

The SEC says Nikas profited from buying Syngenta securities in 2015 after first being passed information about Monsanto Co’s proposal to acquire it and later about ChemChina’s interest.

source reuters

Ask me anything

Explore related questions