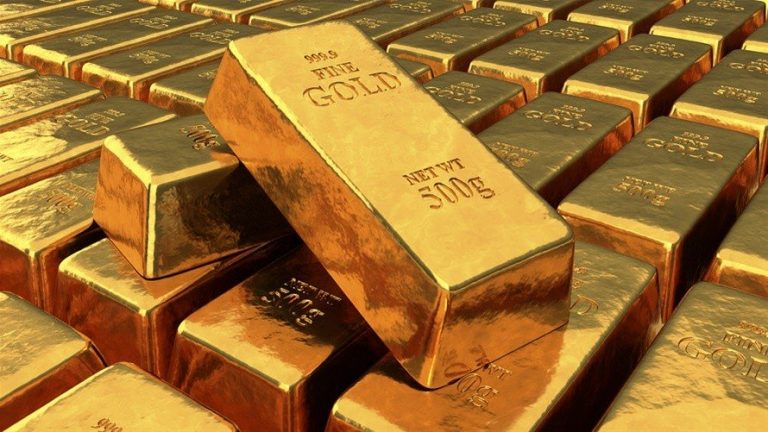

The price of gold fluctuates but historically over the long term, it trends higher. At the time of writing, the 10-year increase is 55.67%.

This means that if you invested $1,000 in gold 10 years ago, it would be worth $1,550 today.

Additionally, reviewing the pricing trends for 2020, you can see that gold prices spiked during the global pandemic as investors favored commodities over stocks. This is a typical trend during economic downturns and times of uncertainty.

Let’s take a closer look at the returns and risks of investing in gold and considerations for including it in your investment portfolio.

Lack of Return

An investment in gold might seem promising until you compare it to the S&P 500. The index which tracks 500 of America’s biggest companies provided a 196.9% return over the last 10 years. That means if you had invested $1,000 in the S&P 500 10 years ago, you’d now have $3,362. That’s substantially more than gold.

Chadwick Boseman: Marvel’s “Black Panther” has died at the age of 43 (video)

However, some investors consider gold to be more of a “safe haven” than the stock market. With no transfer of risk, there is no risk premium with gold, which is expected to retain its real value over time. That comes at a price. Investments considered lower risk like bonds and gold typically return less than riskier securities. It also doesn’t achieve the level of asset diversification you’d get from a robo-advisor.

Read more: Benzinga

Ask me anything

Explore related questions