In an article under the title “Give the Greeks their freedom” the newspaper compares the German Minister of Finance with the Bavarian Catholic first king of the liberated Greek state, that was imposed on Greece by the Great Powers in 1832.

Greece back then was in debt to the Great Powers after the War of Independance in 1821. Since then, the country’s independence has arose many times. So now, the French newspaper wonders, the question comes back again: what does it take to lift the “Greek curse”? This country never was actually financially independent.

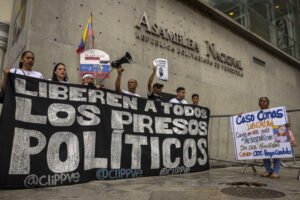

Life sentence

Klaus Regling, head of the ESM that has lent 175bn Euros to Greece, describes this slavery-like situation very well: “A cynical analysis of the facts indicates that we shouldn’t worry about the Greek debt” and that because, as he explained, the interest for this money is just 1%, something that allows Greece to save 8 bn Euros every year, which is 4,5% of the GDP. Also these loans are of long maturity, an average of 30 years, something that neutralizes the IMF’s argument that based on 10-year estimates, considers the Greek debt non viable.

For him, the Greek debt is viable as long as the Greeks remain under the control of the Europeans and adopt the reforms dictated to them from Brussels for the next 30 years…

Ask me anything

Explore related questions