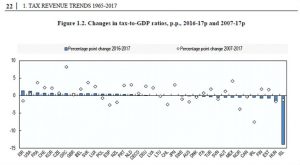

Greece recorded the highest tax increases in the 2007-2017 decade, almost twice from Mexico, the country second on the list, according to the OECD Revenue Statistics Report 1965-2017.

Taxes in Greece also rose in the two years 2016-2017 (blue bar) as Greece was the 7th in tax increases in the world.

The rise in taxes has been experienced by almost all European countries in 2010-2014. But after that 4-year period, the tax rises plateau off or even fall in some cases, something not achieved in Greece as it recorded a reverse trend.

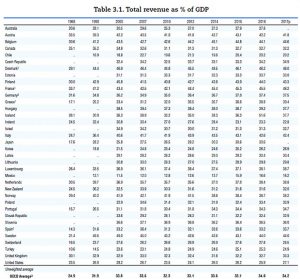

In 1965, Greece was one of the three countries with the lowest tax burden (17.1% of GDP against an average of 24.9%).

In 1995, Greece was again below the average of 34 OECD countries (25.2% vs. 31.9%).

In 2000, it moved to the OECD average (31.2% of GDP versus 31.9%). The same occurred in 2007 (32% vs. 32.3%).

During the “black” 2010, at the outbreak of the crisis taxes were hovering was just the OECD average (32% versus 32.3%)

In 2012 (1st Memorandum), the tax burden in Greece skyrocketed to 35.5% (+3.5 points compared to 2010). At that stage, it was above the OECD average, which also rose to 33.1% (+0.9 points).

In 2014, with the advent of the second Memorandum tax increases in Greece were halted or increased slightly (35.7% of GDP or + 0.2 points), while international growth was even higher: 33.5% or +0.5 points in the OECD.

In 2017, taxes in Greece started rising again and currently stand at 39.4 percent of GDP (+ 2.8 points in 3 years), while the OECD average also rose to 34.2 percent (or +0, 6 units from 2014). But the gap between Greece and other countries is now 5.2 points, or 3 points higher than in 2014.

Ask me anything

Explore related questions