VAT hikes took effect, on beef, for instance, even before the ink was dry on a law approving the framework package with European creditors, the now infamous “Greekment”.

The bill was passed by a comfortable margin in Parliament in the early morning hours of Thursday, with 229 out of 300 deputies voting in favor, despite nearly three dozen ruling SYRIZA MPs going against the “party line” in an unprecedented internal dissent.

Alas, here are some of the “highlights” of the bill:

— Unless the language in the bill is changed or amendments are made, the discounted VAT rate will be abolished in all islands as of Jan. 1, 2017.

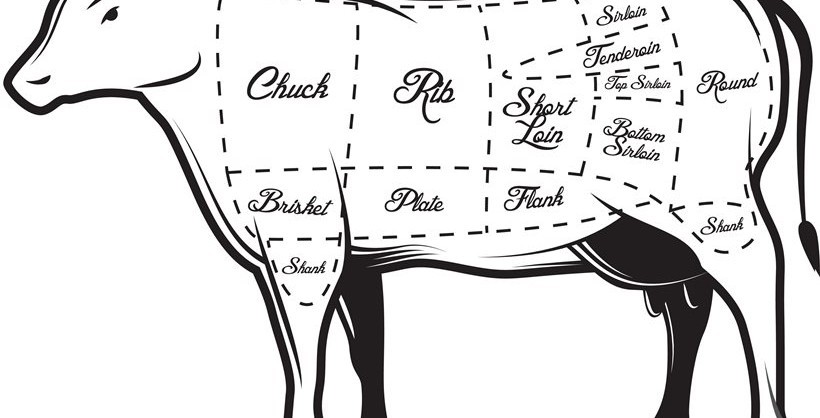

— Fresh beef will sell for 8.8 percent percent more.

— A VAT rate of 23 percent will be applicable to all meat products, such as sausages and luncheon meats.

— Sugar and vinegar will also see VAT rates up, from 13 percent to 23.

— For yogurt lovers, however, the rate remains at 13 percent, without exception.

— Livestock sales also jump to 23 percent, regardless if the rate for specific consumer products remains at 13 percent.

— Fertilizers, insecticides and pesticides will also sell at the highest VAT rate, 23 percent

— The highest rate will be slapped on cinema tickets, concerts, sports events, circus performances, festivals, amusement parks, zoos, exhibitions etc.

— VAT rates for condoms, tampons, as well as firewood and … funeral services, including the still not available cremation process, will also increase.

The third memorandum will apparently be implemented in a “fast track” mode, meaning that VAT rates will be increased … immediately.