Right after Moody’s warning about the Greek economy, Bofa Merrill Lynch came forward with a statement that criticizes the Greek government. According to the statement, the bonus to the pensioners that the Greek government announced was a unilateral decision that not only violated the agreement, but was also based on an overoptimistic calculation of the expected surplus.

Merrill Lynch is worried that this could “make things worse”, something that brings back memories from the summer of 2015 and the negotiations that almost resulted to a Grexit. This time, however, a possible crisis could mean the end of Tsipras’ administration, as the pressure could pave the way to elections.

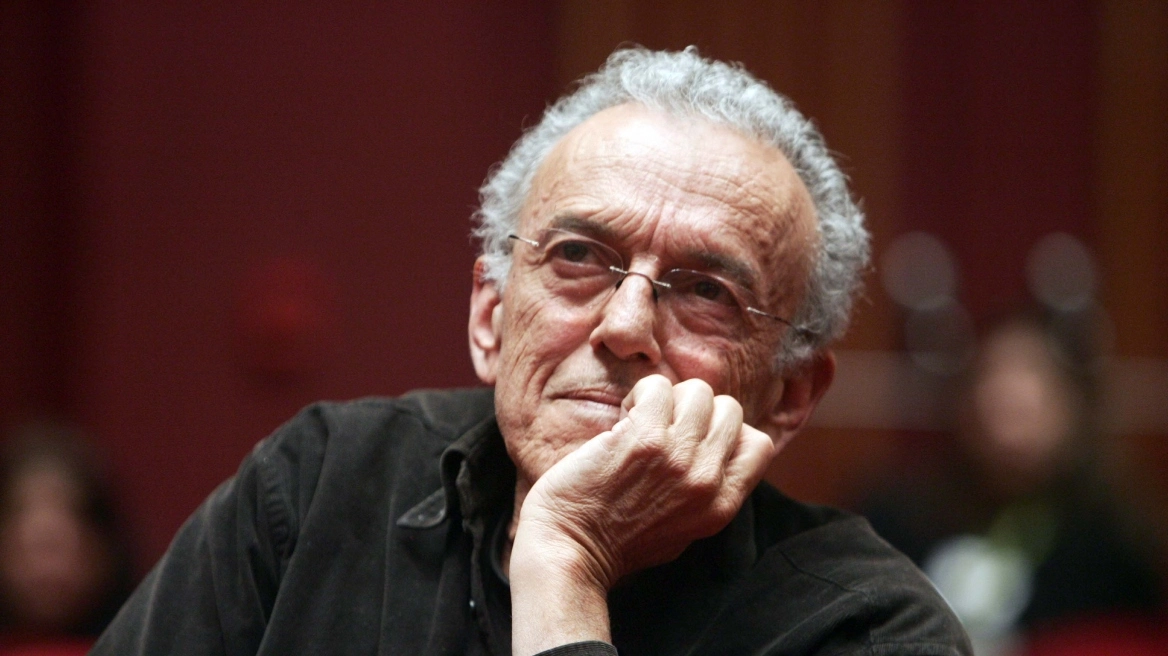

According to Athanasios Vamvakidis, head of the bank in London, this violation could lead to an extension of the evaluation process and thus leave Greece with practically no money. This will have as a result that Greece will be forced to accept a far worse deal than.

All this uncertainty prevents investors from investing in Greece making the road to economic development even harder. As mr. Vamvakidis states, any delay will work against the Greek demand for a debt relief, something that is unfair for all the Greek businesses that the government owes money to.

Ask me anything

Explore related questions