Last week, the Trump administration announced it was imposing tariffs on steel and aluminum of 25 and 10 percent respectively. The president has stated the move is necessary on the grounds of national security and in order to fight back against an assault on the U.S. by foreign competitors. Saving American steel and aluminum jobs was one of Trump’s pledges on the campaign trail with both industries impacted by the import of cheaper products. Even though it fits perfectly with his “America First” policy, could the move to impost tariffs have ramifications?

It has already caused friction within the Republican Party where there are fears of a trade war and some have questioned whether it will undermine decades of progress in international trade. Protectionism could also have an impact at the state level. Although tariffs could provide U.S. steel and aluminum companies with welcome relief in a market flooded with foreign competition, they have already resulted in retaliatory tariffs on key U.S. exports to other countries. High steel prices could also have far-reaching effects on U.S. states, hitting important industries like auto manufacturing and construction.

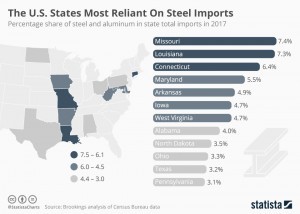

A Brookings Institute analysis of Census Bureau data reveals the states most likely to be impacted by the new tariffs. Missouri and Louisiana accounted for the highest share of steel and aluminum imports last year at just over 7 percent of total imports. The latter is heavily reliant on imported steel to support its oil, gas, and petrochemical industries. Up until now, Canada and Mexico have been excluded from the tariffs but Trump has threatened to change this depending on the outcome of NAFTA renegotiation talks. The U.S. imported 5.7 million metric tons of steel from Canada last year, the highest of any country, while 3.2 million tons came from Mexico. Despite that, the impact of the tariffs could be severe in certain states with many counting on a far longer list of countries for their steel and aluminum imports. For example, Illinois relies on Brazil for 41 percent of its steel and China for 29 percent of its aluminum.

source: statista

Ask me anything

Explore related questions