Three shipowning women from Chios are leaving a strong mark on international shipping, with moves that combine strategy, investment boldness, and operational stability. They are the newsmakers of the day.

Mrs. Semiramis Paliou of Diana Shipping is moving dynamically toward the acquisition of Genco Shipping, offering shareholders a significant premium and seeking to create a strengthened group in the dry bulk market. Mrs. Maria Angelicoussi is making a dynamic return to VLCC supertanker orders through Maran Tankers, capitalizing on high freight rates and geopolitical shifts in the oil market. Mrs. Angeliki Frangou, head of Navios Partners, is demonstrating stability and strategic foresight, combining strong financial results with fleet modernization and cautious moves that may foreshadow future acquisitions or activist strategies.

Semiramis Paliou

Diana Shipping Inc., owned by Mrs. Paliou, announced at the beginning of the week that it submitted an official letter to the board of directors of Genco Shipping & Trading Limited, proposing the acquisition of all remaining shares of the company for 20.60 dollars in cash per share, totaling 750 million dollars. Diana currently holds about 14.8% of Genco’s share capital.

Diana Shipping’s proposal values Genco at levels reflecting a significant premium compared to its recent stock performance. Specifically, the offer of 20.60 dollars per share corresponds to:

- 15% premium compared to Genco’s closing price on November 21,

- 21% premium compared to the share price on July 17, when Diana first announced its stake in Genco,

- 23% premium compared to the volume-weighted average price of the last 30 and 90 days up to November 21.

At the same time, Diana’s management notes that the offer aligns with the highest levels Genco’s stock has reached over the past decade, giving shareholders the chance to immediately liquidate their investment during a period of increased uncertainty for markets and the sector.

Mrs. Paliou, the company’s CEO, described the proposal as “an attractive opportunity for Genco shareholders to realize immediate cash value, at a premium relative to the company’s historical valuation.”

She emphasized that integrating Genco’s fleet into Diana’s platform will strengthen the group’s overall scale, flexibility, and operational leverage “in a favorable period for the dry bulk market.” She also stressed that financing for the acquisition will come from a new loan structure, while after the transaction the company plans “targeted divestments” to optimize both the fleet and the balance sheet.

Regarding human resources, the CEO assured that Diana “highly values the talent and contribution of Genco’s employees” and that the new group will choose “the best executives from both organizations.”

The proposal has been unanimously approved by Diana Shipping’s board, which states it is ready to enter direct and intensive dialogue with Genco’s board and management to complete the transaction if there is a positive response.

The dry bulk market is closely watching the potential acquisition, which—if completed—would create a strengthened giant in the sector during a period of increased investment incentives and strategic reshuffling. Diana Shipping has a fleet of 36 bulk carriers with a total carrying capacity of 4.1 million dwt and an average age of 12 years, plus two under construction.

Scandinavian banks DNB and Nordea are leading a 1.1-billion-dollar financing package that will allow Greece’s Diana Shipping to proceed with the Genco acquisition while also restructuring its existing debt. This agreement was disclosed in a filing with the U.S. Securities and Exchange Commission (SEC) last Monday after Diana’s announcement.

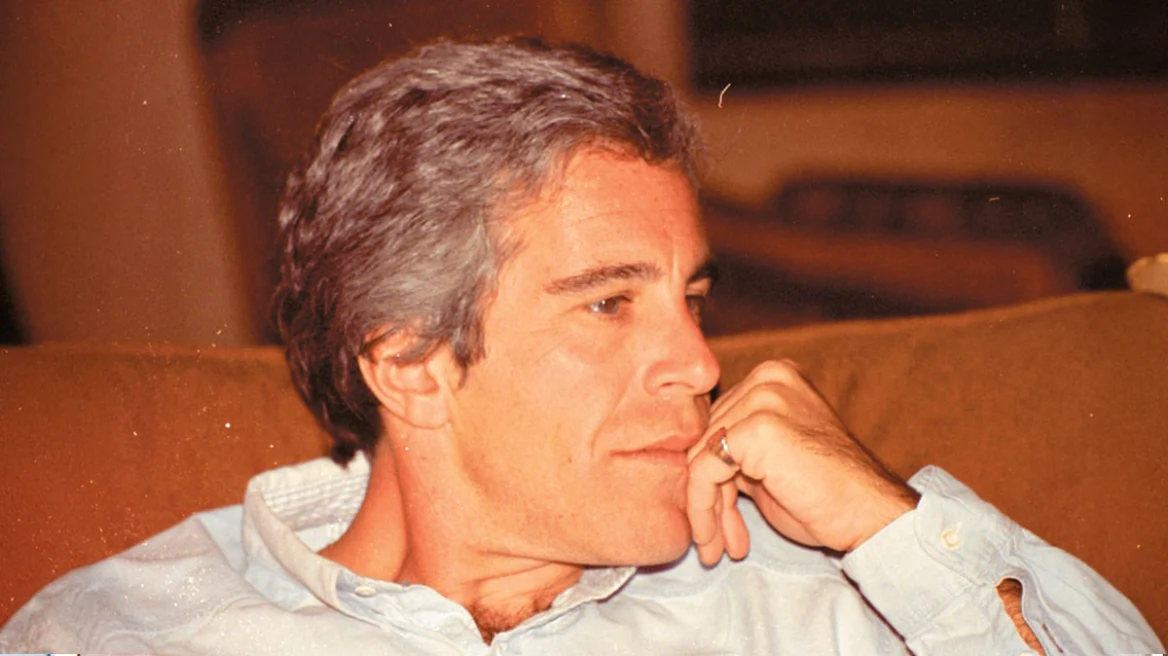

Maria Angelicoussis

Maran Tankers, the tanker arm of the Angelicoussis Group under Mrs. Angelicoussis’s leadership, is making a dynamic return to VLCC supertanker construction—ships over 300,000 tons—after years of focusing on smaller 150,000-ton suezmax vessels. The company has already reached an agreement with South Korean giant Hanwha Ocean for the construction of four new VLCCs, with total costs reaching 515 million dollars.

This move signals Maran Tankers’ return to the largest tanker size category, at a time when market conditions are generating strong investment interest.

In recent years, the company has primarily placed suezmax orders, maintaining a program of 11 such ships, including three shuttle tankers equipped with Dynamic Positioning (DP) technology, which allows a ship to maintain its position and heading automatically and accurately without anchoring or passive anchor use.

The most recent VLCC delivered to the group was the “Antonis I. Angelicoussis”, the world’s first dual-fuel LNG supertanker, which received an award from the Green Award Foundation. It was followed by the VLCCs “Maria A. Angelicoussis,” “Maran Danae,” and “Maran Dione.”

Meanwhile, Maran Tankers has renewed and streamlined its fleet by selling a total of nine older vessels since August 2022, most recently the “Maran Antares,” a 317,000-dwt tanker built in 2012 at Daewoo shipyards, for around 80 million dollars.

Today, Maran Tankers’ tanker fleet counts about 40 vessels, according to the company’s available data. The group’s total fleet reaches 158 vessels—tankers, LNG carriers, and bulk carriers—with a carrying capacity of 23.5 million tons and 10.1 million cubic meters. A shipbuilding program for 22 new vessels is underway.

The new round of shipbuilding is not accidental. The international oil market is undergoing intense restructuring due to sanctions on Russia and restrictions faced by Iran.

New U.S. sanctions on Rosneft and Lukoil have frozen about 48 million barrels of Russian crude that are either in transit or awaiting loading.

Meanwhile, 35% of the global VLCC fleet, which today totals 908 ships, is over 16 years old, increasing replacement needs, especially under new environmental requirements.

VLCC freight rates have soared this year. Last week they reached 137,000 dollars per day, up 576% since the start of the year and the highest since April 2020.

The average VLCC index rate rose to 116,400 dollars per day, a five-year high. The latest surge occurred almost immediately after the latest U.S. sanctions, confirming how sensitive the tanker market is to geopolitical developments.

Increased production from the U.S. and OPEC+ producers—mainly in the Middle East—aligns with buyers’ need for safe, reliable cargoes, far from gray zones. Only last week, 12 new charter fixtures for Middle East crude loading for November and December were recorded.

The redirection of energy flows to larger, more stable routes further boosts demand for large tankers and makes Maran Tankers’ new order fully aligned with market needs.

The company’s decision to place a new order for four VLCCs during a period of abrupt upheaval in the oil market and soaring freight rates is a strategic move with long-term focus.

Angeliki Frangou

The financial results of Navios Partners have fed speculation among Wall Street analysts who focus on the moves of shareholder activists. A few days ago, shipowner George Economou stated that Navios Partners could become a target of a future activist campaign.

He clarified, however, that he personally does not have the time to play the role of activist—a statement that sounds more like “don’t look at me, look around” than true distancing.

In the international market, two types of activism are now discussed: “big A activism,” which shakes up boards and overturns strategies, and “little a activism,” which is milder, doesn’t shout, but hints and sends messages.

A new trend analysts are watching is this: more and more shipowners are buying equity stakes in publicly listed competitors. Officially, for investment reasons. Unofficially, stock-market chatter grows: could these positions be neither passive nor activist? Could they be precursors to acquisitions?

In the third quarter, the company posted 193.9 million dollars EBITDA and 56.3 million dollars net profit, while for the nine-month period the numbers rise to 519.8 million dollars EBITDA and 168 million dollars net profit, with earnings per share of 1.90 and 5.62 dollars, respectively.

From Wall Street’s perspective, these results are not only impressive but also show systematic management and strategic planning. Mrs. Frangou highlights that the company managed to maintain its shipping focus despite constant changes in the operating environment, reducing the fleet’s average age to 9.7 years, increasing contracted revenue to 3.7 billion dollars, and reducing net LTV to 34.5%.

Essentially, the message sent by the Chian shipowner is clear: stability, risk diversification, and continuous modernization. In a sector often marked by volatility and cyclicality, Navios Partners presents the picture of a company that leverages conditions to its advantage.

For investors, the interpretation is twofold: on the one hand, strong financial figures and stable fleet management inspire confidence. On the other, Mrs. Frangou’s strategic approach suggests that the company could become a target for activist investors or future M&A (mergers and acquisitions) moves—something Wall Street players are watching closely.

The company manages a fleet of 171 vessels—tankers, bulk carriers, and containerships—with a carrying capacity of 15 million DWT and 287,243 TEU, with an average age of 9.7 years. It has a shipbuilding program for eight containerships scheduled for delivery between 2026–2027.

Ask me anything

Explore related questions