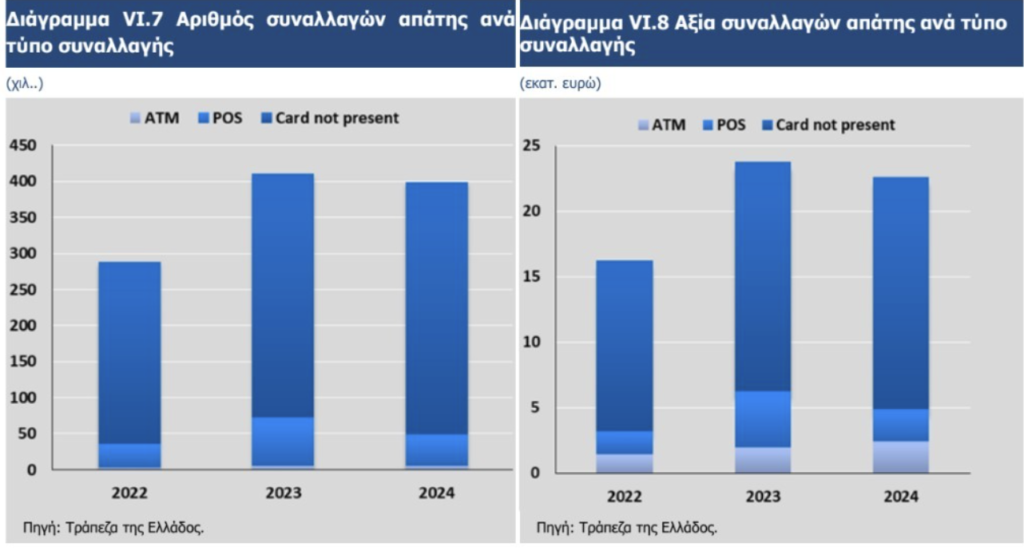

Hackers are usually one step ahead of those tasked with combating cyber fraud. They continuously specialize in striking their victims remotely, constantly discovering new tactics and methods. In 2024, fraudulent transactions amounted to 399,000, slightly down from 410,000 in 2023.

The year 2024 was marked by mixed trends in card transaction fraud in Greece. While the overall fraud index dropped significantly—thanks to strengthened security and public awareness—an increase in online and ATM-related incidents highlights the dynamic nature of cyber threats and the need for constant vigilance.

At the same time, the fact that a large portion of fraud costs is borne by consumers themselves reinforces the need for more targeted protection and support for digital payment users.

New forms of fraud mainly focus on online purchases and ATM withdrawals, with the burden of financial loss shifting more toward users and payment service providers. Still, the percentage of fraudulent transactions remains extremely small relative to the total volume of transactions.

Types of Fraud on the Rise

According to data from the Bank of Greece, as presented in its recent Financial Stability Report, 2024 saw a 4% increase in remote transactions without physical card presence, known as Card-Not-Present (CNP) transactions. These reached 349,000 transactions, up from 337,000 in 2023. Correspondingly, the value of fraud rose by 1%, reaching €17.7 million. These are mostly online transactions with foreign businesses, confirming the continued exposure of consumers to risks in international e-commerce.

Additionally, there was an increase in ATM-related fraud, with the number of incidents slightly rising by 2%, but with a significant 22% increase in value, reaching €2.4 million, up from €2 million in 2023. This confirms that although consumers are increasingly turning to digital payments, traditional transaction methods like ATMs remain vulnerable to organized fraud networks.

Who Pays the Price of Fraud?

The financial damage caused by fraud is far from negligible—and it isn’t borne solely by banks. In fact, data shows that in 2024, consumers (cardholders) bore the largest share of losses, at 58%.

They are followed by payment service providers (such as merchants and POS terminals) who absorbed 35% of the losses, while card issuers (banks) bore the smallest burden at just 8%. This distribution depends on who is deemed responsible for the fraud, revealing gaps in consumer protection in an increasingly complex digital environment.

Significant Decrease in POS Fraud – Why It Happened

At the same time, there has been a notable decline in POS (Point-of-Sale) transaction fraud—i.e., fraud involving physical card terminals in stores. In 2024, POS fraud transactions dropped by 35%, and their total value fell by 43%, amounting to €2.4 million, down from €4.2 million in 2023.

This improvement is largely attributed to a sharp reduction in fraud from lost or stolen cards. Such transactions decreased by 39% in number and 54% in value—falling from 65,000 to 39,000 transactions, and from €3.7 million to €1.7 million respectively. This is partly due to improved systems for immediate card blocking and alerts, as well as the adoption of secure authentication technologies like 3D Secure.

Overall Decline in Fraud Intensity – Security Measures Paying Off

Despite increases in some fraud categories, the overall data paints a positive picture. The fraud-to-transaction ratio (a key indicator) decreased significantly compared to the previous year:

- Fraudulent transactions dropped by 3%

- Fraud-to-transaction volume ratio fell to 0.016% (1 fraud per 6,300 transactions), down 14%

- Fraud-to-transaction value ratio dropped to 0.020% (1 euro lost per €4,900 transacted), down 13% compared to 2023

The Importance of Education and Prevention

The encouraging results highlighted in the Bank of Greece’s annual report are credited to a combination of prevention and awareness initiatives, including:

- The ongoing anti-cyberfraud campaign since 2021, in collaboration with the Hellenic Bank Association, Ministry of Citizen Protection, Greek Police, and the Bank of Greece.

- A February 2024 campaign with MasterCard spotlighting new fraud methods and countermeasures.

- Educational content on the Bank of Greece’s social media, as part of the OECD’s Global Money Week, including a video on safe digital payments.

These initiatives appear to be bearing fruit, with a growing number of citizens becoming more capable of identifying suspicious activity and exercising greater caution in their financial transactions.

Ask me anything

Explore related questions