Investment bank Goldman Sachs is moving forward with an upward revision to the target prices of Greek banks, an expectations upgrade and a positive forecast for 2025-2027. The investment attractiveness of the sector is coming to the fore as Greek banks are on the threshold of a new investment era. Goldman Sachs is making a significant upgrade of their valuations, seeing stability, profitability and room for further upside.

In its latest report dated July 8, the investment bank highlights strong earnings momentum and structural improvements across the sector, even after an impressive rally of +58% year-to-date—more than double the performance of the European banks index.

New Price Targets:

- Alpha Bank: €3.70 (from €2.70) – Buy

- Piraeus Bank: €7.40 (from €6.00) – Buy

- National Bank of Greece: €13.10 (from €10.70) – Buy

- Eurobank: €3.30 (from €2.90) – Neutral

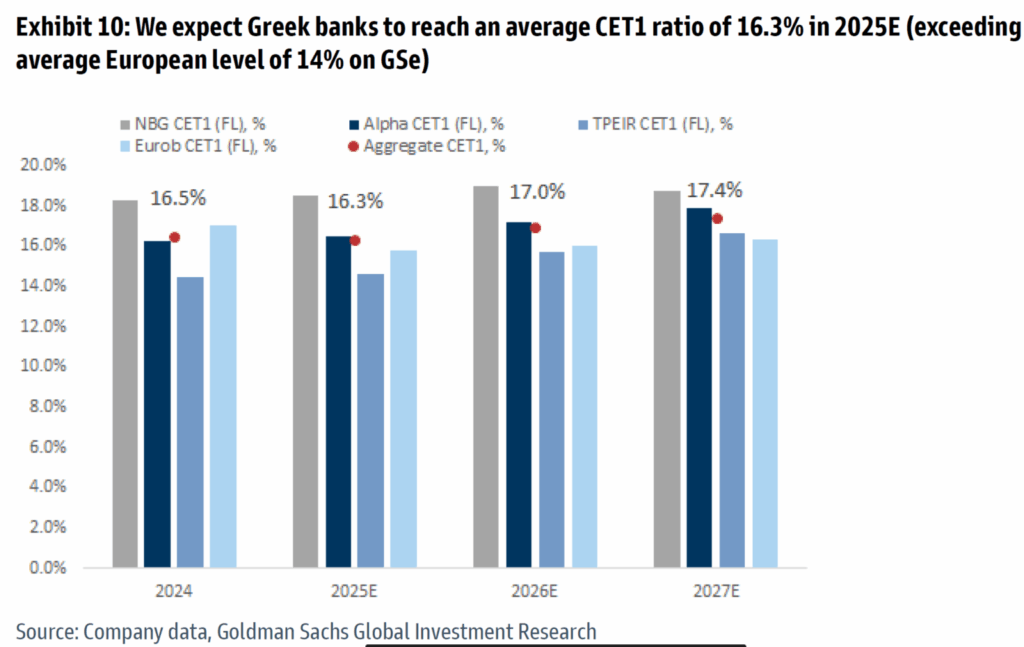

On average, price targets were raised by +24%, while Goldman expects the current 10%-12% valuation discount (in P/TBV terms) versus European peers to narrow to 5%-7% over the next 12 months.

Bank-by-Bank Breakdown

Alpha Bank

Deemed the “most insulated” from falling interest rates, with only a 14 bps NIM compression forecasted vs. 30 bps for peers. ROTE is projected to rise from 10% to 13% by 2027.

- 2026 P/TBV: 0.9x

- Upside: +17%

- Rating: Buy

Piraeus Bank

Stands out for strong fee generation (fee/assets: 0.9%), a very low NPE ratio (2.1%), and solid capital buffers (CET1: 15.6%).

- Upside: +23% (highest among peers)

- ROTE: 14.4%

- Rating: Buy

National Bank of Greece (NBG)

Maintains the sector’s strongest capital base (CET1 >18.5%), highest NPE coverage (>100%), and ample room for future dividends—up to 70% payout by 2028–2029.

- Upside: +18%

- Rating: Buy

Eurobank

Despite strong profitability (ROTE ~14%) and CET1 at 16%, its already elevated valuation (P/TBV 1.1x) limits upside.

- Upside: +9%

- Rating: Neutral

Three Pillars of the Upgrade

Goldman’s more optimistic view is based on:

- Upward earnings revisions (+6% on average for 2026–2027),

- Updated valuation metrics for 2027, and

- Reduced cost of equity (COE) from 15.5% to 13.75%, reflecting improved macro-financial stability and lower risk premiums across Europe.

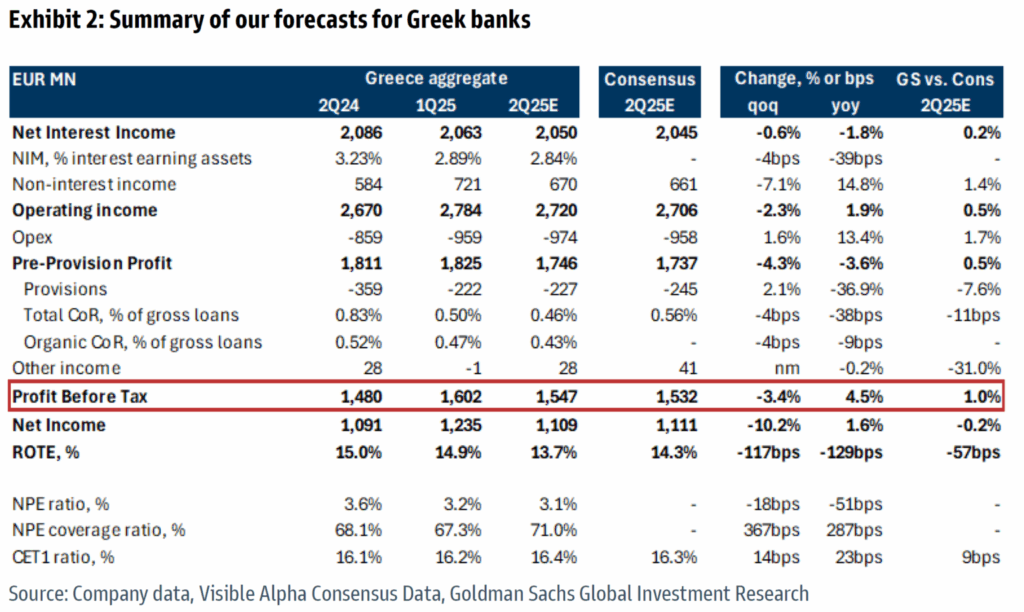

Rate Risk Offset by Credit Growth

While the ECB’s recent rate cuts (new DFR forecast at 1.75%) pose a headwind, Goldman believes it will be offset by robust credit growth and higher yields on securities and spreads.

In Q1 2025 alone, loan books grew 12%-16%, well above management guidance.

Structural Strengths Support Long-Term Story

Goldman underlines that Greece’s banking system has undergone a credible transformation:

- Lower operating costs

- Higher fee income

- Reduced provisioning needs

- Resilient net interest income despite rate pressure

With valuations still low and earnings outlook improving, Greek banks remain one of the most compelling investment cases in the European banking universe.

Ask me anything

Explore related questions