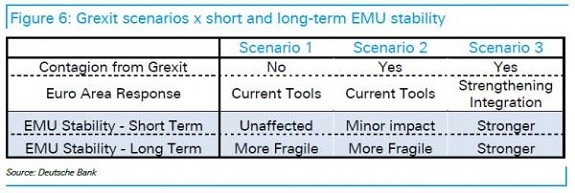

Here’s three DB scenarios over “Grexit”:

-Grexit Scenario 1: No contagion

In the first scenario, Grexit occurs but has no contagion occurs

– Grexit Scenario 2: Contagion

In scenario 2, after a Grexit there would be an increase in volatility and a negative market reaction, including a widening of peripheral government spreads, a flight to quality in the bond market, weaker equities and weak risk markets in general.

-Grexit Scenario 3: A stronger monetary union

In Scenario 3 euro area leaders understand that Grexit destroys the argument that membership in the euro area must be considered permanent. Investors will no longer be able to assign a zero probability that a similar political mistake will not happen again during the next crisis. The rise of populist parties across the euro area reinforces the risk.

In conclusion the article supports that the most efficient ex-post response from euro-area partners is the one in Scenario 3, however, unfortunately, it is the least likely.

Furthermore, the article stresses that whether Scenario 1 (no contagion) or 2 (contagion) is most likely depends on market perceptions of two factors, those being politics and the ECB.