After investors in the United States had largely shrugged off the impact of the coronavirus for the better part of the past month, the mood turned sour on Monday. A broad market sell-off led by technology and airline stocks resulted in all major indices suffering big losses amid growing fears of the virus spreading outside China.

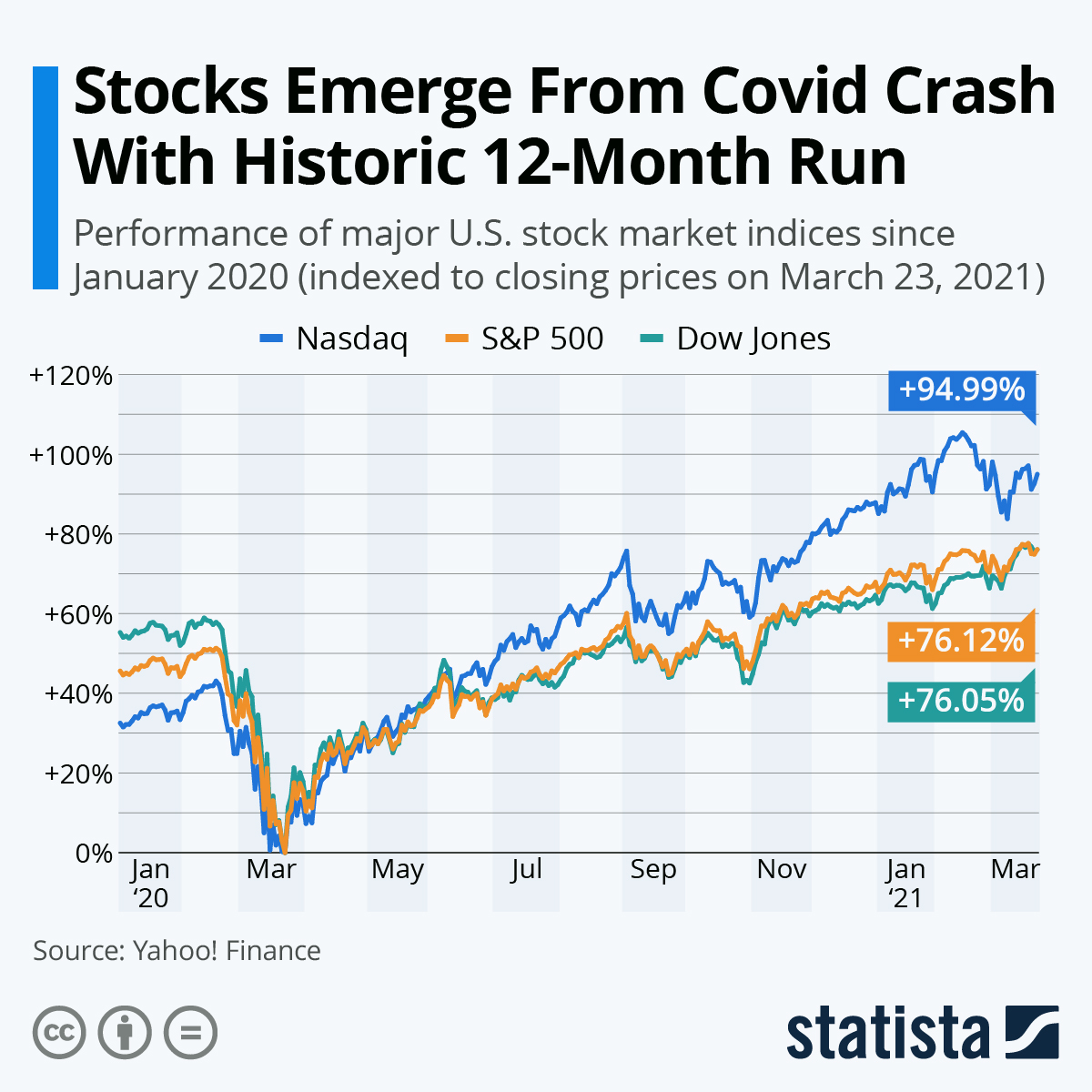

The Dow Jones Industrial Index shed more than 1,030 points (-3.56 percent) on Monday, marking the third-largest single-day point drop in the index’ long history. The tech-heavy S&P 500 also dropped by 3.35 percent as the GAFAM group of tech companies collectively shed $237 billion in market capitalization. Both the Dow Jones and the S&P 500 are now in the red for 2020, as the losses of the past few days erased all gains from the previous six weeks. The Nasdaq Composite Index also dropped by 3.7 percent on Monday, but it’s still up 2.7 percent year-to-date.

While the latest news coming out of China are encouraging, with recoveries now outpacing new infections, hopes of the epidemic being largely contained there have taken a severe hit on the weekend. While not officially classified as a pandemic by the WHO yet, the virus’ global footprint continues to grow. Both Italy and South Korea saw new infections spike on the weekend, sparking concerns that the outbreak’s impact on the global economy could be worse than originally expected.

source statista

You will find more infographics at Statista

You will find more infographics at Statista

Ask me anything

Explore related questions