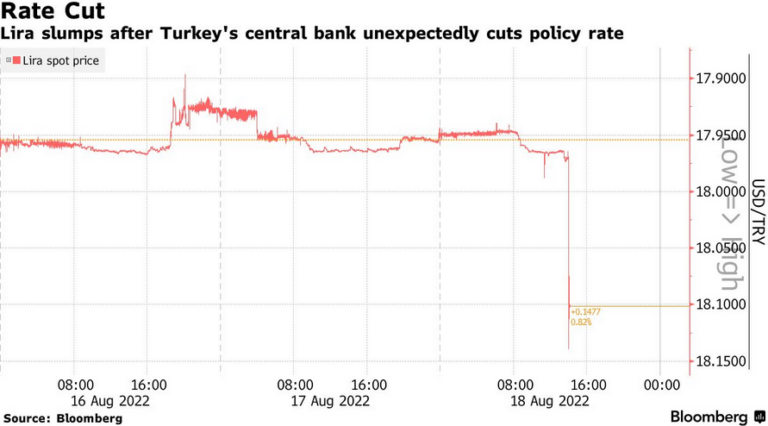

Turkey’s central bank delivered a shock cut to interest rates despite inflation soaring to a 24-year high and the lira trading near a record low. The currency weakened sharply.

The Monetary Policy Committee led by Governor Sahap Kavcioglu lowered its benchmark to 13% on Thursday, after keeping it at 14% since December. All 21 economists surveyed by Bloomberg expected no change. The Turkish currency declined about 1% against the dollar before paring losses.

The MPC signaled it’s only responding to a possible slowdown in manufacturing and not embarking on a monetary-easing cycle, saying “the updated level of policy rate is adequate under the current outlook,” according to a statement.

In Sweden, Muslim rapist gets US$96,000 while victim gets US$340

“It is important that financial conditions remain supportive to preserve the growth momentum in industrial production and the positive trend in employment in a period of increasing uncertainties regarding global growth as well as escalating geopolitical risk,” the MPC said.

Read more: Bloomberg

Ask me anything

Explore related questions