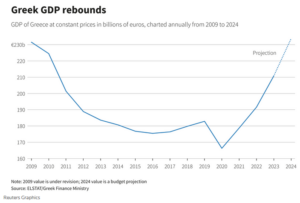

A decade ago, Greece was in the throes of a devastating debt crisis marked by years of austerity, hardship and unrest. Now, officials and investors say 2024 could be the year its rebound is finally complete.

The Greek economy is forecast to grow nearly 3% this year, approaching its pre-crisis size of 2009 and far outpacing the euro zone average of 0.8%.

Borrowing costs have plummeted to below those of Italy, and banks bailed out during the crisis are set to be fully privatised for the first time in decades – a move some of the country’s largest investors see as a final sign of normality.

“With (the state’s participation) out of the way, that’s a landmark,” said Wim-Hein Pals of asset manager Robeco, which recently bought shares in Greek banks.

“The Greek economy is in good shape to benefit from further growth going forward.”

The turnaround in Greece, whose debt crisis threatened to cause the demise of the whole euro zone, is stark – on paper at least. Now the country faces a novel problem: being held back by stagnation in the same euro zone giants that once imposed strict reforms on its economy.

After years shut off from international markets, Greece returned to investment grade credit rating in 2023. When the state’s bailout fund last month sold its stake in Piraeus Bank, opens new tab, one of the country’s largest, the sale was oversubscribed eight times.

Challenges remain, however. Falling birthrates and labour shortages threaten the long-term outlook, and the spread of climate-related disasters like wildfires and floods have strained government finances.

Many ordinary Greeks reeling from the crisis say they see little difference as economists say the wider benefits of the rebound will take time. To ensure long-term growth, the country needs to diversify beyond the typical economic drivers of tourism, real estate and services.

Continue here: Reuters

Ask me anything

Explore related questions