German newspaper Suddeutsche Zeitung leaked a set of documents showing IMF estimates for Greece by 2030. The data shows that, even in the best-case scenarios, Greece would still face an unsustainable debt even if it agreed to the crippling measures that include tax hikes and spending cuts proposed by the European Commission, European Central Bank and the IMF in exchange for 15.5 billion euros in loans from creditors.

These estimates published by the German daily and viewed by the Guardian support Greece’s decision to not accept the bailout deal if it wants to survive economically. Debt relief rather than austerity would save Greece, shows the data.

The IMF figures show that the country would find it increasingly difficult to sustain a 118% debt level bearing in mind that in 2012 the organization said that 110% is the highest debt threshold the country could take on. Instead of keeping levels low, the country’s debt exploded to 175% of the GDP, a figure that could spiral out of control.

One of the six leaked documents, titled the Preliminary Debt Sustainability Analysis for Greece states that even if the economy had a growth rate of 4% per year for the next five years then debt would only decline to 124%:

“It is clear that the policy slippages and uncertainties of the last months have made the achievement of the 2012 targets impossible under any scenario.”

It should be noted that these files were sent to all German MPs for review prior to Greek Prime Minister Alexis Tsipras’ decision to call a referendum and reject the austerity proposals that he believe would have spiked the humanitarian crisis currently taking place.

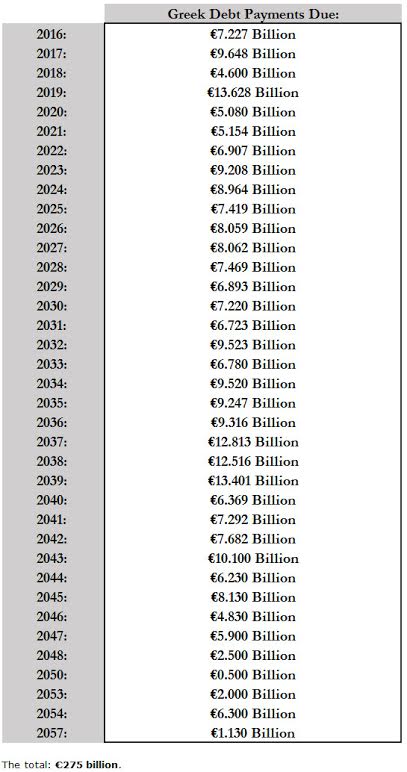

Greece’s failure to pay the 1.6-bn euros due to the International Monetary Fund what actually not all that Greece needed to get out of its predicament. Here are the calculations of what the Greeks really need to get a full bailout from Zero Hedge.