Poor Alexis Tsipras.

For days, the Greek leader has been working the phones, trying to secure the best possible terms for his country as it enters the last mile of its seemingly endless cycle of bailouts. So far, his efforts have won him more mockery than respect — especially in Germany.

“He keeps calling the whole time, and the chancellor says again and again, ‘Alexis, this issue is for the finance ministers,’” German Finance Minister Wolfgang Schäuble told an audience here on Tuesday, referring to the Greek prime minister’s attempts to win over Angela Merkel to his cause.

Eurozone finance ministers are set to decide at a meeting in Luxembourg on Thursday whether to release a more than €7 billion tranche of aid to Greece. No one doubts Athens will get the money. Schäuble all but committed to it on Tuesday. But Tsipras wants something even more precious: debt relief.

No serious economist believes Greece will ever crawl out from under its more than €300 billion debt without significant forgiveness from its creditors. That means convincing Germany, the country to which Greece owes the most.

For much of Greece’s nearly decade-long depression, the country was hostage to its domestic politics. Now, it’s hostage to Germany’s.

Berlin, which has long opposed outright debt relief, refuses to budge. With a general election in Germany set for late September, Merkel and Schäuble are unlikely to soften their position anytime soon. The Greek bailouts remain politically toxic in Germany, and any agreement involving debt forgiveness would be seen domestically as an admission the rescue effort had failed — and at the German taxpayers’ expense.

Over the years, Germany has quietly accepted more subtle forms of forgiveness, like extending maturities on Greece’s loans and reducing the interest burden. But a straightforward cut, as demanded by the International Monetary Fund, remains out of the question. At least until after the election.

(Polish Foreign Minister Witold Waszczykowski said Greece amount to little more than a German colony)

Unfortunately for Tsipras, he has very little say in the matter. One big reason he wants debt relief now is that it would allow the European Central Bank to include Greece in its bond-buying program, known as quantitative easing.

That would go a long way toward boosting investor confidence in Greece’s stability. But Greece won’t be eligible for the program as long as its debt burden isn’t deemed sustainable. And with the ECB’s program set to be wound down soon, Greece may never benefit.

Tsipras may yet try to resist a deal this week and take the matter to next week’s summit of European leaders in Brussels. That’s unlikely to make much difference.

Truth is, Europe stopped listening to Greece a long time ago.

Gone are the days when talk of “Grexit” (Brexit’s forgotten sire) triggered a nervous tick across financial traders’ faces. Today, mention of Greece is more likely to elicit a glazed look, if not a yawn. With the country’s debt safely out of the hands of the credit markets and in the vaults of the ECB and Europe’s treasuries, Athens can no longer rattle the global financial system.

Tsipras didn’t understand that dynamic until after he and his leftist Syriza coalition were elected in early 2015. Syriza won by promising to reverse much of the austerity creditors had imposed on Greece over the years. Buoyed by the victory, Tsipras held a referendum on whether the government should accept bailout terms negotiated by his predecessor. Voters’ response was clear: Oxi, No.

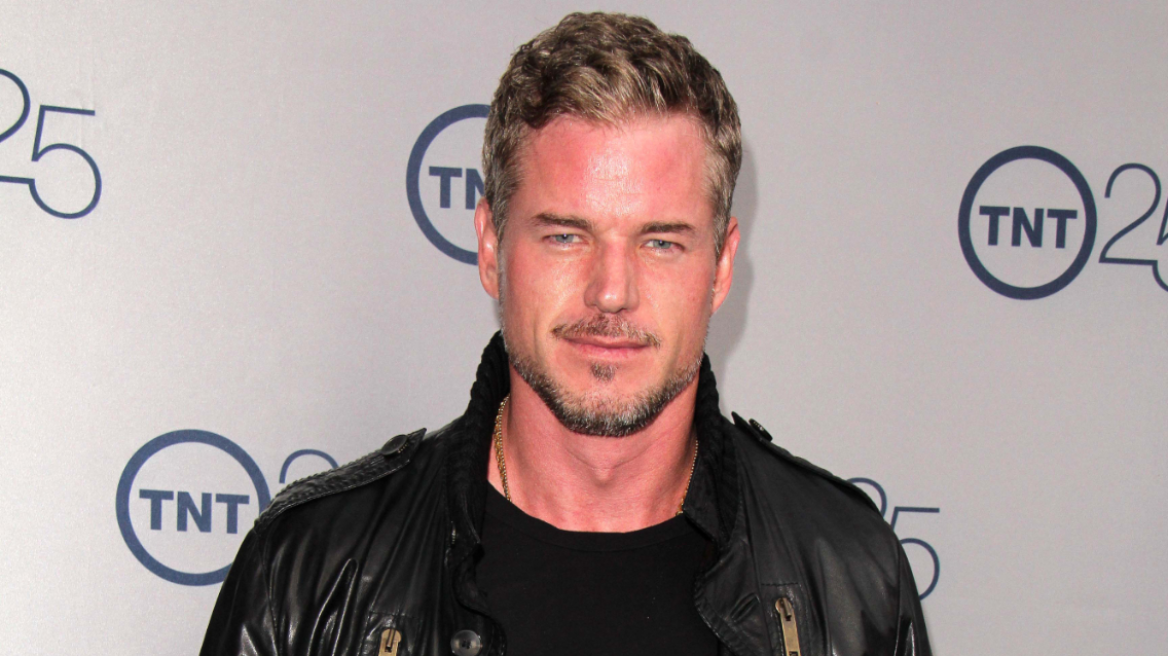

Then reality set in. Faced with the collapse of Greece’s banking system, exit from the eurozone and a future even bleaker than the present, Tsipras and his band of leftist firebrands came to heel. Yanis Varoufakis, the “rockstar” finance minister who once advocated “sticking the finger to Germany,” was forced out.

Ever since, Tsipras has largely complied with creditors’ demands for further budget cuts and economic overhauls. Berlin and its partners confronted his occasional bouts of resistance with simple patience. In the end, they knew the Greek leader would have no choice but to relent.

Time and again, they were proven right. Just last month, Tsipras pushed through cuts to pensions, a move once unthinkable.

From the beginning of the crisis, part of Germany’s strategy for dealing with Greece has been not to make the process too easy. Though German officials won’t say so publicly, making an example of Greece has always been part of their plan.

And it’s worked. Across Europe, Greece has become synonymous with economic incompetence. Officials in other European capitals refer to Athens like a wayward, unrepentant relative. No one wants to be like Greece.

“Greece is de facto a colony,” Polish Foreign Minister Witold Waszczykowski said in an interview with POLITICO, explaining his country’s resistance to joining the euro. “We don’t want to repeat this scenario.”

Despite the challenges that reputation poses, Greece is holding out hope that it will ultimately get what it wants.

For one, the IMF has been on its side for more than a year, refusing to participate in the bailout unless there’s debt relief. Germany’s parliament made its approval of the bailout in 2015 contingent on the participation of the IMF, which lawmakers regard as a guarantor that the process won’t be skewed in Athens’ favor.

That has led to a protracted standoff. Last week, IMF Managing Director Christine Lagarde proposed a sleight of hand that would allow the bailout to go forward. The IMF would formally join but not release any funds until after the Europeans spell out what kind of debt relief they will accept.

If that happens at all, it won’t be until after the German election. In the meantime, Tsipras has little choice but to heed the wishes of his “colonial” masters.

Ask me anything

Explore related questions