By EU Economic and Monetary Affairs Commissioner Pierre Moscovici

Global growth and world trade are expected to strengthen modestly, though at a slightly slower pace than envisaged in winter.

It is the gradual recovery in advanced economies which should mainly drive global growth, from 3.4% last year to 3.5% this year. Next year, the momentum of world growth should further increase to 3.9%.

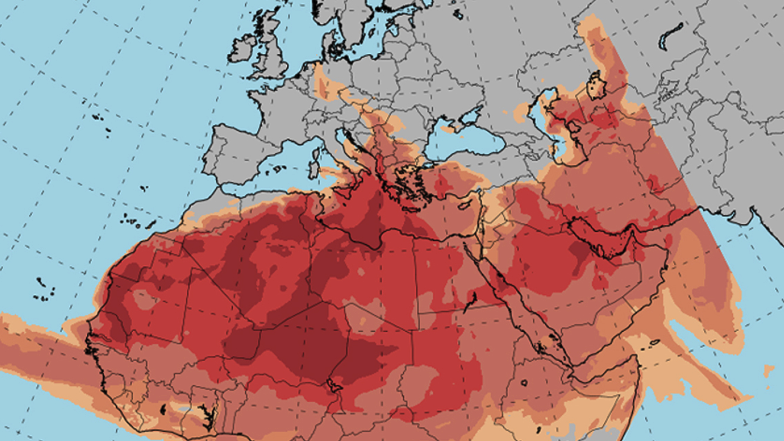

Growth in emerging markets is expected to remain steady in 2015 and to pick up a little in 2016. For commodity-exporting countries, the economic prospects have worsened since the winter notably in Russia, the Middle East and North Africa, Sub Saharan Africa, but also Latin America.

EU growth gradually firming

Now let me turn to the main news of today after this analysis.

In the EU as a whole, real GDP growth is forecast to rise from 1.4% in 2014 to 1.8 % this year and to accelerate further to 2.1% in 2016.

In the euro area, growth is expected to pick up from 0.9% last year to 1.5% in 2015 and 1.9% in 2016.

For 2015, our forecast has thus been revised up by 0.1 percentage points for the EU and 0.2 percentage points for the euro area, compared with our Winter Forecast three months ago.

For 2016, tailwinds should remain strong enough to mitigate the impact of slightly less dynamic global trade and a stronger rebound in oil prices, compared to what we assumed in the winter. Accordingly, at this moment, the growth forecast remains unchanged for 2016. As a result, economic output in both regions is now expected to exceed its pre-crisis peaks next year.

Tailwinds pushing activity to different degrees

All countries in the EU are set to gain from the positive tailwinds, but the extent to which they will benefit will depend on several factors such as the varying responsiveness of their individual economies to lower oil prices and the euro depreciation. The ECB’s quantitative easing is also likely to have a higher impact in countries with tight financing conditions.

Among the largest Member States, GDP growth in 2015 is expected to be above the EU average (of 1.8%) – in Poland at 3.3%, Spain at 2.8%, and the UK at 2.6%.

Economic growth in Germany at 1.9% will be also above the EU average, driven by robust domestic demand with private consumption underpinned by an improving labour market.

In France, the economy is expected to grow by 1.1% this year and to slowly gain momentum in the next two years, primarily driven by private consumption.

In Italy, GDP is expected to grow by 0.6% this year, thanks to increasing external demand, with growth set to strengthen next year once investment picks up.

Among the euro-area Member States that have or have had adjustment programmes, growth is expected to remain robust in Ireland (3.6%) and to gather momentum in Portugal (1.6%) thanks to improved domestic demand and strong exports. In Cyprus, GDP growth is expected to turn positive only next year.

Greece

Let me add a word on Greece.

In our winter forecast, we had projected GDP to grow by 2.5% in 2015 and 3.6% in 2016. However in light of the persistent uncertainty, a downward revision has been unavoidable.

We now expect Greek GDP to grow by only 0.5% in 2015 before a strong rebound to 2.9% in 2016.

This forecast is based on the assumption that the ongoing review of the program will be concluded by June, which you know is the EC’s objective.

It goes without saying that all of our projections for Greece are subject to a particularly high degree of uncertainty, since discussions about policy measures are continuing now between the institutions and the Greek authorities.

Private consumption: the main growth driver

GDP growth in the EU and the euro area is expected to continue to be driven by strong private consumption growth.

In contrast, investment has been the weak spot of the recovery. It has remained subdued, reflecting moderate demand growth, economic and policy uncertainty, corporate deleveraging and credit supply constraints.

Exports are expected to accelerate this year and next, helped by stronger global import demand and the euro’s depreciation.

Recovery in the labour market progressing

Concerning the labour market, employment growth is benefiting from strengthening economic activity.

Unemployment is on a declining path, but remains of course far too high in several countries. Unemployment in the EU and the euro area is expected to fall this year to 9.6% and 11.0% respectively, as improvements in the labour market spread across sectors.

With growth expected to strengthen further in 2016, the trend of reducing unemployment should continue, particularly in countries which have recently implemented labour market reforms.

In 2016, unemployment is set to fall to 9.2 % in the EU and 10.5 % in the euro area.

Hints of a rebound in inflation rates

Inflation is expected to remain below zero in the first half of the year, as lower oil prices are passed through to the broader economy.

Inflation should, however, begin to pick up in the second half of the year and even more so in 2016 as:

* domestic demand strengthens,

* output gaps narrow,

* the effects of lower commodity prices fade,

* and the depreciation of the euro triggers higher import prices.

* Annual consumer price inflation in both the EU and the euro area is expected to rise from 0.1 % this year to 1.5 % in 2016.

Differences in fiscal performance

The fiscal outlook is improving:

* In the euro area, the deficit is forecast to fall from 2.4% of GDP in 2014 to 2.0% this year and 1.7% in 2016.

* In the EU as a whole, the deficit is forecast to decline from 2.9% of GDP in 2014 to 2.5% this year and 2.0% in 2016.

Moreover, for the first time since the onset of the crisis, this is very important news, the debt burden is also decreasing. The debt-to-GDP ratio is estimated to have peaked in 2014 -at 89% in the EU and at 94% in the EA-. It is expected to decline this year and even more so next year, as the nominal GDP picks up.

In many Member States, deficit ratios are projected to continue falling in 2015 and 2016, helped by stronger growth and lower interest payments on public debt.

In the euro area, we expect only France, Spain, Portugal and Finland to post deficits above the 3% threshold this year.

Our forecast takes into account measures included in the Stability or Convergence Programmes for 2015, provided that these were known before the cut-off date of the spring forecast (21st of April) and provided that they were considered to be credibly announced and specified in sufficient detail. The Stability or Convergence Programmes will be assessed by the Commission based on these forecasts. So today we are not announcing any kind of decision, but the decision will be based on the forecast.

While the current neutral fiscal stance for the EU as a whole is appropriate in light of the still gradual recovery underway, pursuing fiscal responsibility remains essential.

* Member States with large deficits and/or debt have to consolidate further. This is clearly the view of the Commission.

* Those with fiscal space should foster productive investment.

* Everywhere, the composition of public finances can be designed in a more growth-friendly manner. And we insist on that, this is very important for the future.

The Commission will assess compliance with the rules of the Stability and Growth Pact against the background of today’s forecast. This assessment will conclude with our country-specific recommendations which will be published in mid-May, meaning in a few days from now.

Risks to the growth outlook

Risks to the growth outlook are broadly balanced.

- Upside risks:

* are linked to the boost from the low oil prices

* as well as from the ECB’s QE, which could both be stronger than expected.

* Also, the Investment Plan for Europe, for which a cautious approach has prevailed in our assessment, could have a stronger-than-expected impact.

* Finally, export volumes and investment could react more strongly to the euro’s depreciation than projected.

- There are also downside risks:

* including geo-political risks, as tensions related to the Russia-Ukraine conflict remain high.

* Also, if oil prices rebound faster than assumed, this could erase the windfall gains from lower energy prices.

* In financial markets, the risk of renewed financial market volatility could weigh on economic growth.

* Risks surrounding the inflation outlook have moderated as a result of the ECB’s quantitative easing and in response to the upward revisions to the growth outlook.