A 15-20% tax, payable in a lump sum, will reportedly target specific individuals and businesses in order to collect much-needed revenue owed by alleged industrial-scale tax dodgers. The initiative is reportedly being planned at breakneck speed in an effort to funnel 923 mln euros into state coffers ahead of a looming Feb. 28 date, whereby a bailout agreement with institutional creditors lapses.

The government’s plan moves on two axes:

1. Investigating the so-called Lagarde List and Lichtenstein List, along with the names of people with offshore companies etc. The main goal is to immediately find taxable income by cross-checking Greek citizens’ Tax Identification Numbers (AFM) to find those who systematically dodged taxes on a massive scale. Sources state that names to be checked include prominent individuals suspected of large-scale tax evasion through profits gained in the underground or grey economy.

2. Another plan, developed by Finance Minister Yanis Varoufakis’ team, is aimed at quickly collecting revenue by copying an initiative by the French and Italian states, who allowed tax dodgers on the lists to pay a lump sum tax payment in return for the legal “laundering” of the rest of their cash and an end to further investigation. This process is estimated, by the government, as being able to collect 1-1.5 bln euros.

Nevertheless, not all government cadres are “on board”, as Alternate Finance Minister Nadia Valavani has stressed that she wants “zero tolerance for tax evaders” rather than forgiving them with a lump sum tax slice.

Whistleblower Herve Falciani exposed 2,000 Greeks with money in the Swiss branch of HSBC

Sources point to detailed investigations, especially in cases from the last quarter. “Whatever has been investigated will be looked into yet again,” it is stressed. The Radical Left Coalition (SYRIZA) government is determined to open up all case files, including those of people with close ties to previous governments, so-called economic “oligarchs” and some of Greece’s most prominent citizens.

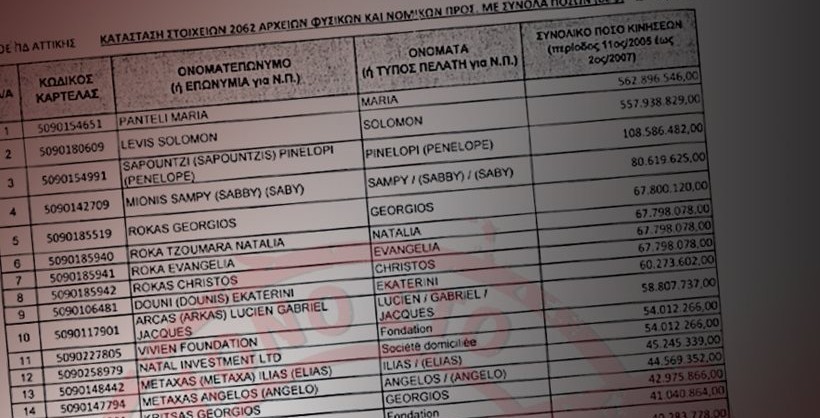

The first page of the Lagarde List

The Cabinet-level head of the authority to combat money laundering, Panagiotis Nikoloudis, is on a race against time with a new assets test to be formulated within May that would include bank deposits as well as other assets. Interestingly enough, a number of Greece’s wealthiest alleged tax evaders have rushed to tax offices seeking to settle their outstanding debts so that they can be spared from further consequences – and embarrassment.

According to sources, the greatest focus will be on offshore companies where more 15 bln euros is expected to have been exported, however, only 150 cases have been investigated. More than 20,000 taxpayers are being scrutinized for sums sent abraod from 2009-2011. Of these, only 785 cases have been investigated.

Tax offices are already compiling a list of Greek taxpayers with accounts at specific banks abroad. Data at the hands of Greek authorities comes from cooperation with foreign banks. At least 100 people with huge amounts of money have been identified and have been invited to explain their transactions.

Another important area of investigation for the new government is that of fuel and tobacco products black market. It is estimated that 700-800 mln euros worth of tax revenue are lost through the tobacco black marketing alone, according to Alternate Finance Minister Dimitris Mardas. Much of the focus will be around the Port of Piraeus where these products enter the Greek market.