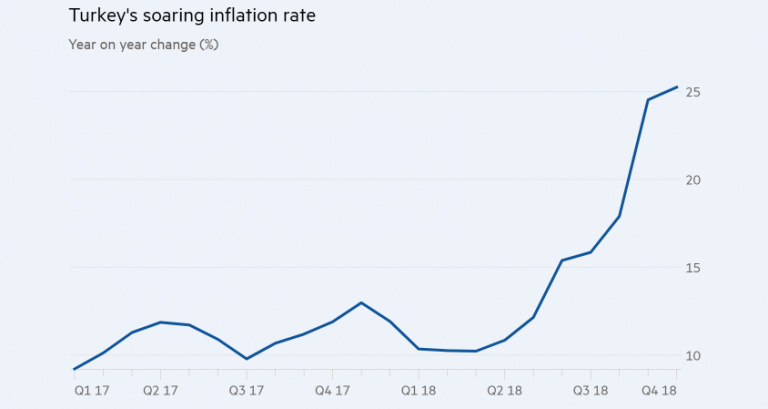

Turkey’s inflation rate rose above 25 per cent in October after a currency crisis this summer made white goods, food and housing more expensive and forced the government to slash its economic growth targets.

Despite the high print, analysts said the central bank will probably resist pressure to increase interest rates because of concerns of a deepening recession after the lira lost almost a third of its value against the dollar this year, sparked by a diplomatic dispute with the United States.

Consumer prices increased 2.67 per cent month-on-month in October, the Turkish Statistical Institute said. The year-on-year change accelerated to 25.2 per cent from 24.5 per cent in September and 10.35 per cent at the start of this year. Consumer price inflation had been forecast to rise at a slightly slower pace of 24.5 per cent, according to a survey by Reuters.

Household appliances rose at the fastest annual clip in October, climbing 38 per cent, and transportation costs followed, up 32 per cent. Food and beverages, which account for about a quarter of the basket of goods used to measure inflation, climbed 32 per cent, and housing prices increased 29 per cent, the institute said.

Still, the inflation figures offer “relief” to the central bank because “they could have been much worse,” Timothy Ash, a strategist at BlueBay Asset Management, said in a note to investors. “Turkey is undergoing a brutal hard landing . . . and the central bank would have been loath to have to increase policy rates again if the inflation data continue to disappoint, as this will just make the recession deeper.”

The central bank, whose monetary policy committee next meets on December 13, has said it will retain a tight monetary policy to bring inflation down. But it left its benchmark rate unchanged last month, even after inflation hit a 15-year high.

The lira was little changed after Monday’s data release.

Read more HERE

Ask me anything

Explore related questions